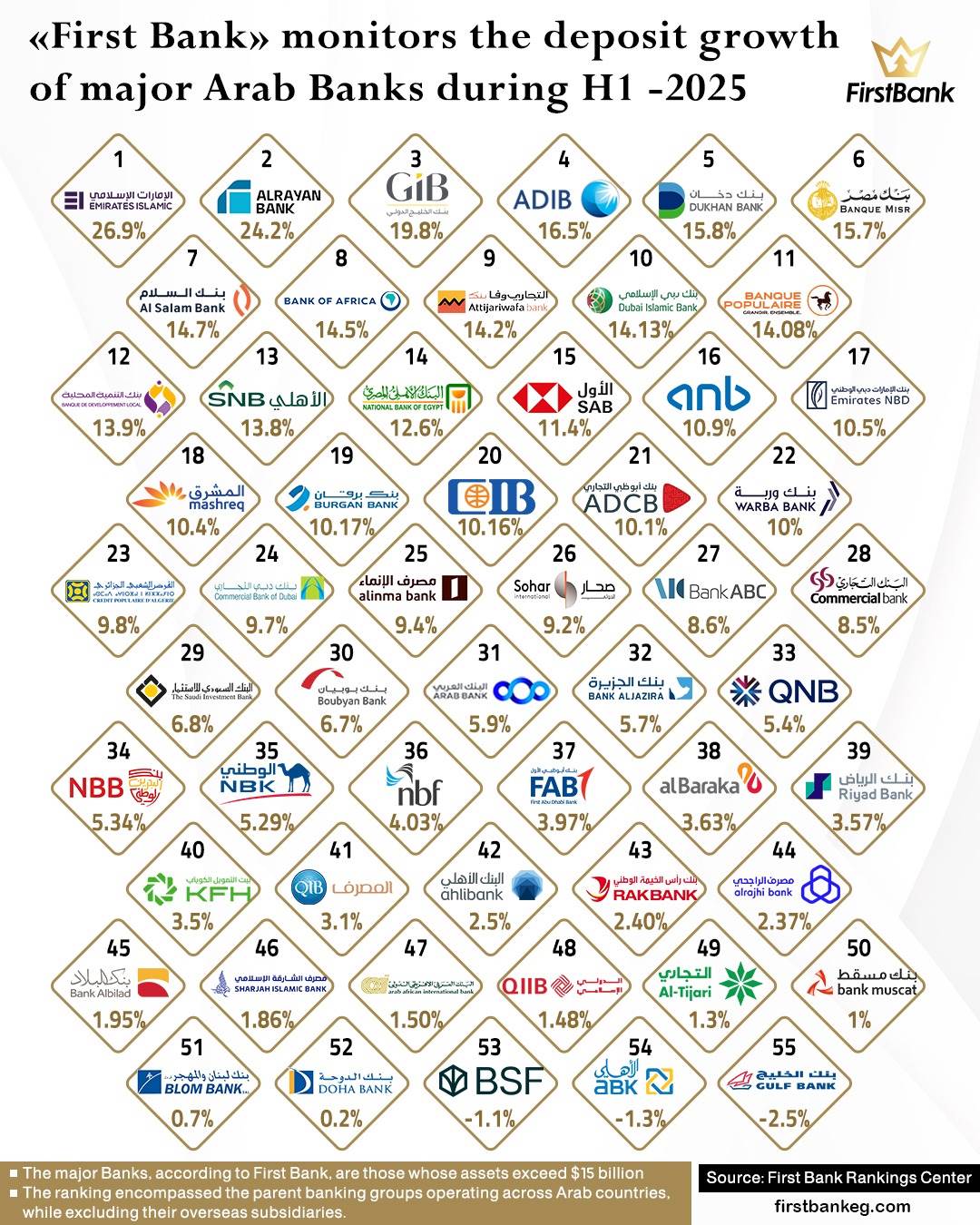

«First Bank» monitors the deposit growth of major Arab Banks during H1-2025

مركز تصنيفات First Bank

The First Bank ranking on the growth evolution of customer deposits at major Arab banks during the first half of 2025 revealed a clear Gulf dominance, with the United Arab Emirates leading the scene by placing three banks among the top 10 fastest-growing banks, reflecting the continuation of its regional influence and the achievement of sustainable growth rates within its banking sector.

The ranking also showed a strong and balanced presence for both Qatar and Bahrain, with each country securing two positions among the top 10 fastest-growing banks, underscoring the resilience and strength of their banking sectors.

Meanwhile, Morocco maintained its regional presence by capturing two positions, while Egypt strengthened its footprint by securing one position among the top 10 fastest-growing banks.

The ranking covered major Arab banks, which the First Bank Rankings Center defines as banks with total assets exceeding USD 15 billion.

Banks were ranked based on the growth rates of total customer deposit portfolios, as officially disclosed and denominated in US dollars, providing a unified and comparable benchmark across different banking institutions.

The ranking excluded banks for which official data were unavailable, ensuring the accuracy of results and the reliability of the adopted methodology. Overall, 52 banks recorded positive growth rates, while three banks experienced a notable decline during the first six months of 2025.

At the top of the ranking, Emirates Islamic Bank claimed the first position, achieving a growth rate of 26.9% during the first half of 2025. Its customer deposit portfolio reached approximately USD 26.52 billion as of end-June 2025, compared to USD 20.91 billion at the end of 2024.

Al Rayan Bank ranked second, posting a growth rate of 24.2% during the first six months of 2025, with customer deposits reaching around USD 2.40 billion by end-June 2025, compared to USD 1.92 billion at the end of 2024.

Gulf International Bank (GIB) secured the third position, with its customer deposit portfolio rising to approximately USD 33.77 billion by end-June 2025, compared to USD 28.20 billion at the end of 2024, reflecting a growth rate of 19.8% during the first half of 2025.

Abu Dhabi Islamic Bank (ADIB) captured the fourth position, achieving a growth rate of 16.5% during the first six months of the year. Its customer deposits reached around USD 57.95 billion by end-June 2025, compared to USD 49.74 billion at the end of 2024.

Dukhan Bank claimed the fifth position, after its customer deposit portfolio increased by 15.8% during the first half of 2025, reaching approximately USD 4.95 billion by end-June 2025, compared to USD 4.28 billion at the end of 2024.

Banque Misr ranked sixth, recording a growth rate of 15.7% during the first six months of the year, with customer deposits reaching about USD 56.86 billion by end-June 2025, compared to USD 49.13 billion at the end of 2024.

Al Salam Bank came in seventh, as its customer deposit portfolio grew by 14.7% during the first half of 2025, reaching approximately USD 3.89 billion by end-June 2025, compared to USD 3.39 billion at the end of 2024.

Bank of Africa ranked eighth, achieving a growth rate of 14.5% during the first six months of the year, with customer deposits reaching around USD 29.11 billion by end-June 2025, compared to USD 25.42 billion at the end of 2024.

Attijariwafa Bank secured the ninth position, after its customer deposit portfolio rose to approximately USD 54.12 billion by end-June 2025, compared to USD 47.41 billion at the end of 2024, reflecting a growth rate of 14.2% during the first half of 2025.

The tenth position was claimed by Dubai Islamic Bank, whose customer deposit portfolio reached around USD 77.24 billion by end-June 2025, compared to USD 67.68 billion at the end of 2024, representing a growth rate of 14.1% during the first six months of the year.

It is worth noting that the ranking included parent banking groups across Arab countries and did not include their foreign subsidiaries.

Evolution of the Deposit Portfolio of Major Arab Banks during the First Half of 2025

| # | Bank Name | Country | Customer Deposits (USD) as of End-June 2025 | Customer Deposits (USD) as of End-2024 | Growth Rate (%) |

|---|---|---|---|---|---|

| 1 | Emirates Islamic Bank | UAE | 26.52 USD bn | 20.91 USD bn | 26.86 % |

| 2 | Al Rayan Bank | Qatar | 2.4 USD bn | 1.93 USD bn | 24.22 % |

| 3 | Gulf International Bank | Bahrain | 33.77 USD bn | 28.2 USD bn | 19.78 % |

| 4 | Abu Dhabi Islamic Bank (ADIB) | UAE | 57.95 USD bn | 49.74 USD bn | 16.51 % |

| 5 | Dukhan Bank | Qatar | 4.95 USD bn | 4.28 USD bn | 15.76 % |

| 6 | Banque Misr | Egypt | 56.86 USD bn | 49.13 USD bn | 15.72 % |

| 7 | Al Salam Bank | Bahrain | 3.89 USD bn | 3.39 USD bn | 14.65 % |

| 8 | Bank of Africa | Morocco | 29.11 USD bn | 25.42 USD bn | 14.52 % |

| 9 | Attijariwafa Bank | Morocco | 54.12 USD bn | 47.41 USD bn | 14.16 % |

| 10 | Dubai Islamic Bank | UAE | 77.24 USD bn | 67.68 USD bn | 14.13 % |

| 11 | Central People’s Bank (BCP) | Morocco | 43.79 USD bn | 38.38 USD bn | 14.08 % |

| 12 | Local Development Bank (BDL) | Algeria | 11.94 USD bn | 10.48 USD bn | 13.87 % |

| 13 | Saudi National Bank (SNB) | Saudi Arabia | 175.63 USD bn | 154.32 USD bn | 13.81 % |

| 14 | National Bank of Egypt (NBE) | Egypt | 109.89 USD bn | 97.61 USD bn | 12.57 % |

| 15 | SAB Bank | Saudi Arabia | 79.19 USD bn | 71.07 USD bn | 11.43 % |

| 16 | Arab National Bank (ANB) | Saudi Arabia | 53.79 USD bn | 48.5 USD bn | 10.9 % |

| 17 | Emirates NBD | UAE | 200.6 USD bn | 181.55 USD bn | 10.49 % |

| 18 | Mashreq Bank | UAE | 48.37 USD bn | 43.82 USD bn | 10.38 % |

| 19 | Burgan Bank | Kuwait | 17.54 USD bn | 15.92 USD bn | 10.17 % |

| 20 | Commercial International Bank (CIB) | Egypt | 20.97 USD bn | 19.04 USD bn | 10.16 % |

| 21 | Abu Dhabi Commercial Bank (ADCB) | UAE | 126.19 USD bn | 114.65 USD bn | 10.07 % |

| 22 | Warba Bank | Kuwait | 11.25 USD bn | 10.22 USD bn | 10.04 % |

| 23 | Popular Credit of Algeria (CPA) | Algeria | 15.06 USD bn | 13.71 USD bn | 9.8 % |

| 24 | Dubai Commercial Bank | UAE | 29.15 USD bn | 26.57 USD bn | 9.72 % |

| 25 | Alinma Bank | Saudi Arabia | 61.31 USD bn | 56.04 USD bn | 9.41 % |

| 26 | Sohar International | Oman | 16.4 USD bn | 15.01 USD bn | 9.24 % |

| 27 | ABC Bank | Bahrain | 24.35 USD bn | 22.43 USD bn | 8.57 % |

| 28 | Commercial Bank of Qatar (CBQ) | Qatar | 22.92 USD bn | 21.13 USD bn | 8.48 % |

| 29 | Saudi Investment Bank | Saudi Arabia | 26.73 USD bn | 25.02 USD bn | 6.81 % |

| 30 | Boubyan Bank | Kuwait | 25.73 USD bn | 24.1 USD bn | 6.74 % |

| 31 | Arab Bank | Jordan | 52.71 USD bn | 49.78 USD bn | 5.9 % |

| 32 | Bank AlJazira | Saudi Arabia | 30.44 USD bn | 28.8 USD bn | 5.7 % |

| 33 | Qatar National Bank (QNB) | Qatar | 256.51 USD bn | 243.38 USD bn | 5.39 % |

| 34 | National Bank of Bahrain | Bahrain | 10.46 USD bn | 9.93 USD bn | 5.34 % |

| 35 | National Bank of Kuwait (NBK) | Kuwait | 78.17 USD bn | 74.24 USD bn | 5.29 % |

| 36 | National Bank of Fujairah (NBF) | UAE | 12.96 USD bn | 12.46 USD bn | 4.03 % |

| 37 | First Abu Dhabi Bank (FAB) | UAE | 221.5 USD bn | 213.03 USD bn | 3.97 % |

| 38 | Al Baraka Group | Bahrain | 7.04 USD bn | 6.79 USD bn | 3.63 % |

| 39 | Riyad Bank | Saudi Arabia | 84.47 USD bn | 81.56 USD bn | 3.57 % |

| 40 | Kuwait Finance House (KFH) | Kuwait | 64.56 USD bn | 62.4 USD bn | 3.46 % |

| 41 | Qatar Islamic Bank (QIB) | Qatar | 4.65 USD bn | 4.51 USD bn | 3.14 % |

| 42 | Ahli Bank Qatar | Qatar | 9.04 USD bn | 8.82 USD bn | 2.45 % |

| 43 | RAKBANK | UAE | 16.63 USD bn | 16.24 USD bn | 2.4 % |

| 44 | Al Rajhi Bank | Saudi Arabia | 171.18 USD bn | 167.22 USD bn | 2.37 % |

| 45 | Bank Albilad | Saudi Arabia | 33.04 USD bn | 32.41 USD bn | 1.95 % |

| 46 | Sharjah Islamic Bank | UAE | 14.36 USD bn | 14.09 USD bn | 1.86 % |

| 47 | Arab African International Bank (AAIB) | Egypt | 13.41 USD bn | 13.21 USD bn | 1.5 % |

| 48 | Qatar International Islamic Bank (QIIB) | Qatar | 1.75 USD bn | 1.73 USD bn | 1.48 % |

| 49 | Commercial Bank of Kuwait | Kuwait | 8.18 USD bn | 8.08 USD bn | 1.25 % |

| 50 | Bank Muscat | Oman | 25.66 USD bn | 25.4 USD bn | 1.02 % |

| 51 | BLOM Bank | Lebanon | 16.11 USD bn | 16.01 USD bn | 0.68 % |

| 52 | Doha Bank | Qatar | 13.98 USD bn | 13.95 USD bn | 0.16 % |

| 53 | Banque Saudi Fransi | Saudi Arabia | 48.71 USD bn | 49.27 USD bn | -1.14 % |

| 54 | Al Ahli Bank of Kuwait (ABK) | Kuwait | 14.12 USD bn | 14.31 USD bn | -1.34 % |

| 55 | Gulf Bank | Kuwait | 14.74 USD bn | 15.12 USD bn | -2.53 % |