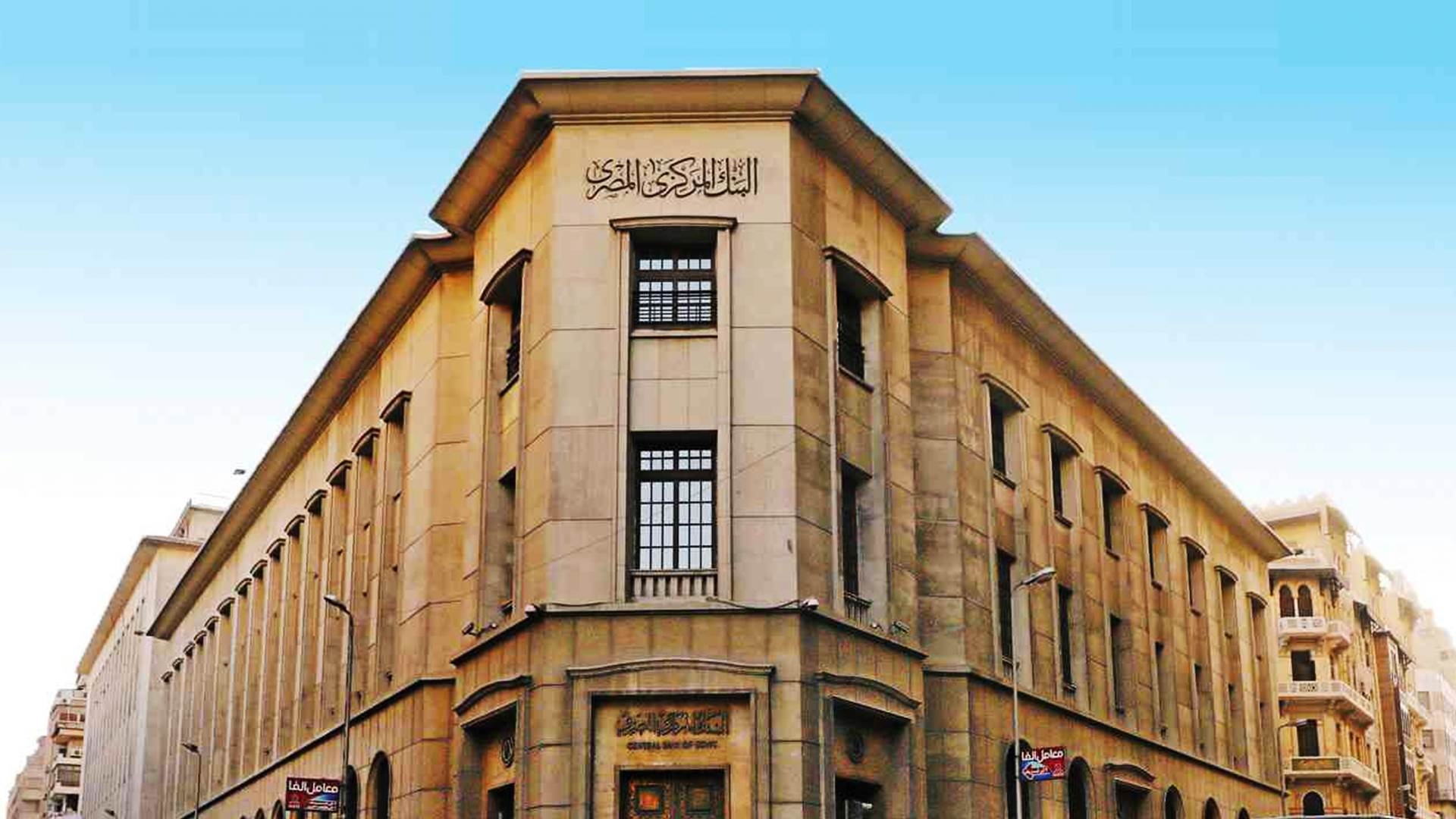

CBE: Financial Inclusion Rates Rose to 70.7% by the End of 2023

First Bank

Central Bank of Egypt (CBE) released the core set of financial inclusion indicators for 2023, highlighting a remarkable surge in the financial inclusion rates in Egypt. The number of adults (16 years and above) who own transactional accounts - whether bank accounts / Egypt Post accounts / mobile wallets / prepaid cards - reached around 46.9 million citizens out of a total of 66.4 million adults.

This has led to a financial inclusion rate of 70.7% by the end of 2023, compared to 64.8% in December 2022, signaling an overall growth rate of 174% during the period from 2016 to 2023.

Egypt’s financial inclusion growth rate, over the past years, marked one of the best among peer countries. The growth rate is reflected through the significant increase in the number of citizens benefitting from financial services that meet their needs, the stimulation of the customers’ savings, the facilitation of financial transactions, and reduction of the cost and time required to execute their transactions, while availing these services at any time and from any place, which contribute to citizens’ welfare, and improve their living conditions.

With regards to the financial inclusion of women, the indicators showed an upsurge in the number of financially included women, reaching 20.3 million women, out of a total of 32.3 million at the end of December 2023, with a growth rate of 244% compared to 2016, signifying an inclusion rate of 62.7%.

The financial inclusion rate of youth (aged 16 to 35) which amount to a total of 36.6 million citizens, reached 51.5%, with a growth rate of 48.5% from 2020 to 2023.

The remarkable upsurge in financial inclusion rates is backed by the fruitful collaboration with all ministries and authorities on the national level, through their active participation in many joint initiatives and events targeting different customer segments. This is in addition to the participation of the Central Bank of Egypt in the first phase of the presidential initiative “Decent Life” by directing banks to be present in many villages, promoting banking products and services, enabling the financial infrastructure, in addition to conducting financial awareness activities.

In terms of availing an enabling environment that encourage dealing with the banking sector, the Central Bank has issued several regulations to overcome obstacles facing all segments of society to acquire financial services that suit their needs, such as allowing the opening of accounts for young people from the age of 16, in addition to facilitating the opening of “Economic Activity Account” for handicraftsmen, and “Financial Inclusion Account” for citizens using only their National ID.

Furthermore, the six financial inclusion events organized under the auspices of the Central Bank of Egypt throughout the year, in synchronization with global events, contribute to reaching for and communicating with citizens in remote and underprivileged areas. During these events, banks are allowed to be present outside their branches and to avail opening accounts with no administration fees or minimum account balance, in addition to disseminating financial literacy, to encourage citizens to use various financial products.

Releasing the core set of financial inclusion indicators by the Central Bank of Egypt is of great importance, as they contribute effectively to track the progress of financial inclusion rates which enable the development of policies that support the economic empowerment of citizens. This comes within the framework of the efforts exerted on the national level, and in alignment to achieving the Sustainable Development Goals and Egypt's Vision 2030.