ABK Egypt records unprecedented profits of EGP1.26bln in 9M-22, the highest in 6 years

Al Ahli Bank of Kuwait (ABK) Egypt is among the fastest growing banks in the Egyptian market over the last few years; its inspiring success story is attributed to the bank’s top executive management led by Khaled El Salawy the CEO & Managing Director.

The veteran banker led the bank since March 2016 after the Kuwait's Al Ahli Bank (ABK) has acquired a 98.5 percent stake in Piraeus Bank's Egypt unit. ABK has paid $150 million for the stake in the Greek lender's Egyptian unit.

Al Ahli Bank of Kuwait (ABK) was founded in Kuwait in 1967. In 2016, it announced the official launch of operations in Egypt through a wide network of branches offering clients a distinguished banking experience and a wide portfolio of exceptional financial solutions for individuals, SMEs and large corporates.

Thanks to Al-Salawy, the bank has seen a sturdy performance while achieving unprecedented net profits. Upon paying a close attention to its 9-months performance; the bank has been found succeeding in achieving a historic leap which is considered the largest since starting its operations in Egypt.

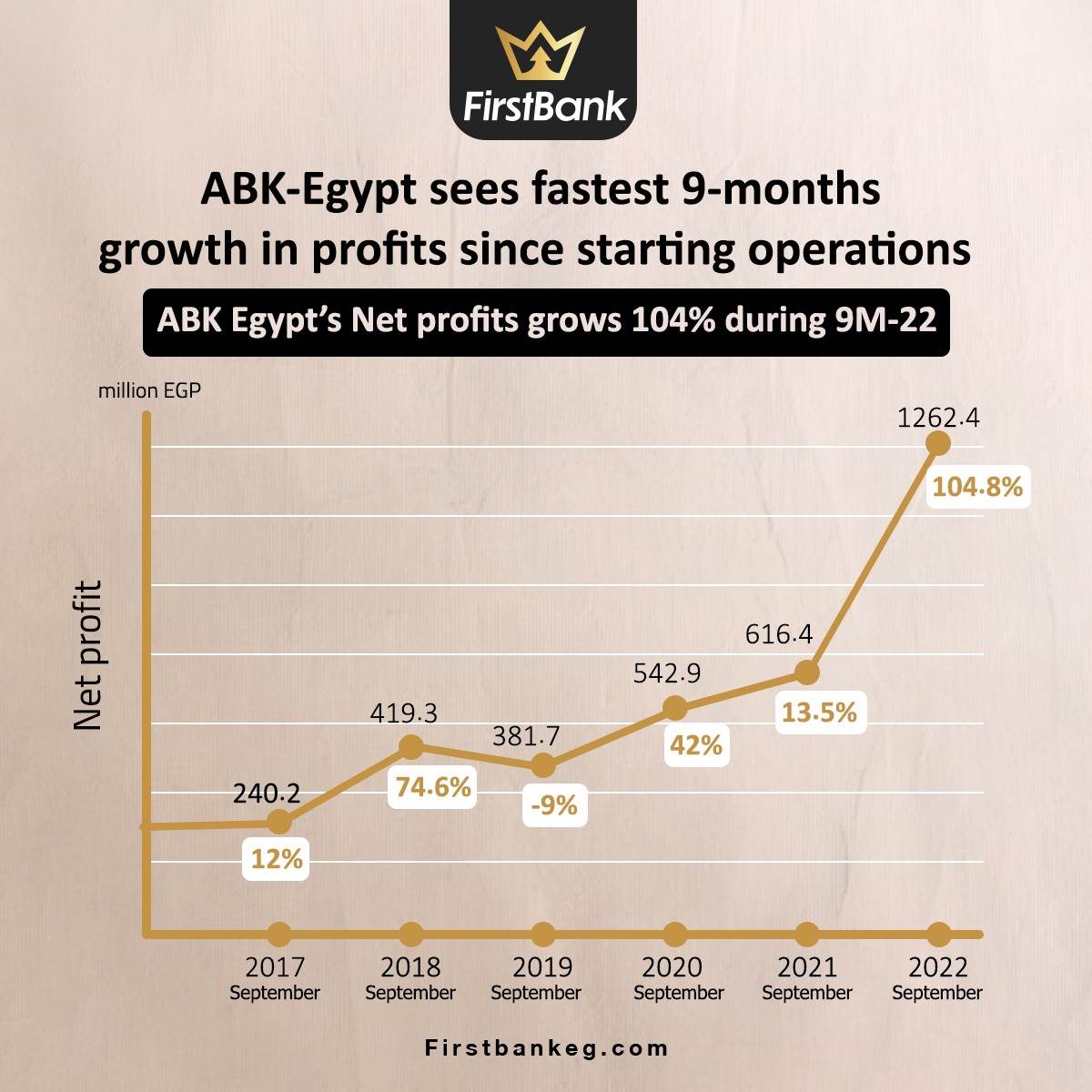

Thus, ABK Egypt’s net profit has jumped by 104.8%, breaking for the first time in its seasonal performance the barrier of one billion Egyptian pounds. It reached EGP 1.26 billion during the first 9 months of 2022, compared to EGP 616.41 million during the same period of 2021 increasing by EGP 646 million.

Moreover, the bank’s pre-taxes profits amounted mounted to EGP 1.7 billion during 9M 2022 compared to EGP 944 million in the same comparable period of 2021 despite the global and local economic challenges.

Khaled Al-Salawy has relentlessly sought to enhance the bank’s successes and strengthen its financial position. The bank has managed to increase its network to 44 branches spread across most of the governorates as well as expand the geographical spread of its ATMs to reach 110.

ABK Egypt strives for more success under the leadership of Al-Salawy who looks forward to continuing to work on his expansion strategy, which relies on offering its customers top-notch services and products while attracting new segments of clients. In addition he aims at finalise his plan to develop the technological infrastructure of the bank as part of Egypt’s digital transformation plans.