Housing Bank directs 25% of its credit facilities portfolio to SMEs under CBE’s instructions

The Housing and Development Bank, leading state-owned lender, was apple to up its credit facilities portfolio directed to companies and micro, small and medium-sized enterprises (SMEs) to 25 percent by the end of 2022, under the Central Bank of Egypt directives.

The bank has directed 11% of its credit facilities to small enterprises by the end of 2022.

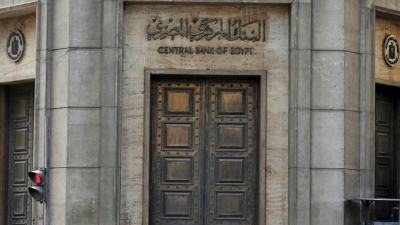

The Central Bank of Egypt (CBE) has earlier instructed the Egyptian banking sector to increase allocations for micro, small and medium-sized enterprises (MSMEs) from 20 to 25 percent of their credit facilitations.

The step was meant to support the manufacturing sector, providing the chance for the informal sector to merge into the formal sector, as well as achieve economic, financial, and monetary sustainable stability.

The central bank added the move is based on President Abdel-Fattah El-Sisi's directives to support the MSMEs sector due to its strategic importance in achieving Egypt’s economic growth and Egypt’s vision 2030 regarding sustainable development strategy.

Hassan Ghanem, the Chairperson of HDB and its Managing Director, asserted that SMEs support is considered a top priority of the bank’s strategic plan for growth given its role in enhancing development, providing job opportunities, and establishing an Egyptian industrial and productive enviroment to create a national competitive industry that enhances the local product. Ghanem also declared that HDB is committed to provide all means of support to SMEs.