aiBank, ADCB Egypt, Housing Bank fastest growing banks in terms of corporate loans in 9M-22

The Arab Investment Bank- aiBank Egypt topped First Bank list of fastest growing banks in terms of corporate loans during the first 9 months of 2022

The bank’s total corporate loans portfolio posted EGP 15.7 billion at the end of September 2022, compared to EGP 7.5 billion at the end of 2021, with a growth rate of 109.2%.

First Bank’s list of fastest growing banks in corporate loans portfolio in 9M included 22 banks

First bank analyses the total corporate loans in 22 banks with available financial statements operating in the Egyptian banking sector and came up with a list of fastest growing banks in terms of corporate loans portfolio in 9M-22.

The analysis revealed that most of the banks recorded positive growth rates in corporate loans portfolio during the period from January to September 2022. However one bank of the 22 banks under analysis has witnessed a decline in its corporate loans portfolio at 9M-22

Abu Dhabi Commercial Bank-ADCB Egypt came in second place with a growth rate of 46.61%, bringing total corporate loans to EGP 21.9 billion at the end of September 2022, compared to EGP 14.9 billion at the end of December 2021.

Egypt’s Housing and Development Bank came in third place, with a growth rate 33.65 % during 9M. Its total corporate loans portfolio recorded EGP 10.5 billion at the end of December 2021, while increasing to EGP 14 billion at the end of September 2022.

In addition, Ahli United Bank was in fourth place; as its total corporate loans portfolio jumped to EGP 47.5 billion at the end of September 2022, compared to EGP 36.2 billion at the end of 2021.with a growth rate of 31.14%.

Furthermore, Arab African International Bank ranked fifth, after its corporate loans portfolio rose to EGP 92.6 billion at the end of September 2022, compared to EGP 72.3 billion at the end of December 2021, with a growth rate of 25.19%.

Moreover, Attijariwafa Bank ranked seventh after its corporate loans portfolio rose to EGP 22.9 billion at the end of September 2022, compared to EGP 18.3 billion at the end of December 2021, with a growth rate of 24.70%.

It was followed by National Bank of Egypt with a growth rate of 23.41% during the same period. Thus, its loans portfolio rose to EGP 1.235 trillion at the end of September 2022, compared to EGP1.016trillion at the end of December 2021,

However, SAIB ranked the tenth among other banks bringing its total corporate loans portfolio to EGP 24.8 billion at the end of September 2022, compared to EGP 30.6 billion at the end of December 2021, with growth rate of 14.90%. It was followed by CIB Egypt with growth rate of 21.39% during the same period.

The figures included in the list are according to the independent financial results announced for each bank by the end of September 2022.

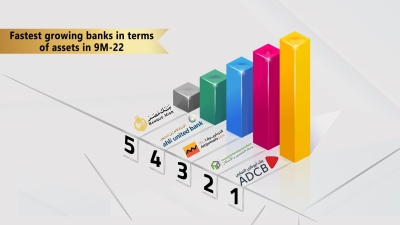

fastest growing banks in total loans portfolio in 9M-22

| # | Bank Name | value in 9M-22 | value in the end of 2021 | growth rate% |

|---|---|---|---|---|

| 1 |

BANK NXT |

15.71 billion pounds | 7.51 billion pounds | 109.19 % |

| 2 |

Abu Dhabi Commercial Bank Egypt- ADCB |

21.854 billion pounds | 14.906 billion pounds | 46.61 % |

| 3 |

Housing and Development Bank-HDB |

14.017 billion pounds | 10.488 billion pounds | 33.65 % |

| 4 |

Kuwait Finance House Bank Egypt  |

47.513 billion pounds | 36.231 billion pounds | 31.14 % |

| 5 |

arab african international bank |

92.637 billion pounds | 72.28 billion pounds | 28.16 % |

| 6 |

alBaraka Bank Egypt |

27.263 billion pounds | 21.778 billion pounds | 25.19 % |

| 7 |

Attijariwafa Bank Egypt |

22.902 billion pounds | 18.33 billion pounds | 24.94 % |

| 8 |

Abu Dhabi Islamic Bank-ADIB Egypt |

43.245 billion pounds | 34.678 billion pounds | 24.7 % |

| 9 |

National Bank of Egypt-NBE |

1.253 Trillion pounds | 1.015 Trillion pounds | 23.41 % |

| 10 |

SAIB BANK |

30.607 billion pounds | 24.831 billion pounds | 23.26 % |

| 11 |

Commercial International Bank-CIB |

148.124 billion pounds | 122.024 billion pounds | 21.39 % |

| 12 |

Credit Agricole Egypt |

24.852 billion pounds | 20.909 billion pounds | 18.86 % |

| 13 |

Export Development Bank of Egypt-EBank |

39.332 billion pounds | 33.154 billion pounds | 18.63 % |

| 14 |

Banque Du Caire-BDC |

73.686 billion pounds | 62.949 billion pounds | 17.06 % |

| 15 |

Qatar National Bank-QNB  |

172.569 billion pounds | 148.486 billion pounds | 16.22 % |

| 16 |

Suez Canal Bank |

27.508 billion pounds | 23.893 billion pounds | 15.13 % |

| 17 |

Al Ahli Bank of Kuwait Egypt -ABK Egypt |

20.158 billion pounds | 17.649 billion pounds | 14.22 % |

| 18 |

Banque Misr |

580.524 billion pounds | 524.869 billion pounds | 10.6 % |

| 19 |

EGBANK |

18.15 billion pounds | 16.664 billion pounds | 8.92 % |

| 20 |

Emirates NBD Egypt |

32.023 billion pounds | 30.416 billion pounds | 5.28 % |

| 21 |

Bank of Alexandria-Alex Bank |

29.675 billion pounds | 28.259 billion pounds | 5.01 % |

| 22 |

Faisal Islamic Bank of Egypt |

11.923 billion pounds | 12.161 billion pounds | -1.96 % |