Egypt’s National Bank is most performing bank on credit competitiveness index at 9M-22

Egypt’s National Bank of Egypt, largest state-owned lender, is a frontrunner on First Bank Credit Competiveness Index during first 9 months of 2022. NBE’s total loans and facilities to customers increased to EGP 1.46 trillion at 9M-22, compared to EGP 1.17 trillion at the end of 2021; an increase of EGP 285.2 billion.

First Bank Credit Competiveness Index measures loans portfolios of 22 banks

First Bank Credit Competiveness Index measures banks operating in Egypt capability of offering credit products or loan products to attract customers either individuals or corporates. It is measured by the absolute value of growth in terms of loans portfolio, which identifies banks success in increasing the balance of their loans portfolios.

First Bank Credit Competiveness Index has monitored an increase on the loans portfolio of 22 banks operating in the Egyptian banking sector, for which financial data was available during the period under analysis. The index revealed that all the banks under analysis were able to double the loans and facilities to their customers during the first 9 months.

Banque Misr was second on the index after it managed to double the total value of loans and facilities to its customers to EGP 671.8 billion at 9M-22 in comparison to EGP 606.8 billion at the end of December 2021; an increase of EFP 65.1 billion

However, the Commercial International Bank – CIB Egypt was ranked third on the Credit Competitiveness Index. Thus, the bank’s total loans and facilities to customers increased by EGP 34.9 billion in 9 months to stand at EGP 198 billion by the end of September 2022 in comparison to EGP 163.1 billion by the end of December 2021.

QNB Al Ahli Bank was the fourth on the index growing by EGP 30.8 billion; thus, its total loans and facilities portfolio increased to EGP 215.6 billion at the end of September 2022, compared to EGP 184.8 billion at the end of December 2021.

Arab African International Bank-AAIB Egypt was the fifth on the Credit Competitiveness Index. Its total loans and facilities portfolio increased to EGP 108.2 billion at the end of September 2022, compared to EGP 86.1 billion at the end of December 2021; an increase of EGP 22.1 billion. It was followed by Banque Du caire which grown by EGP 16.9 billion at the end of the same period.

Ahli United Bank was the seventh on the index growing by EGP 11.8 billion; thus, its total loans and facilities portfolio stood at EGP 50.5 billion at the end of September 2022, compared to EGP 38.7 billion at the end of December 2021. It was followed by Abu Dhabi Islamic Bank which grown by EGP 10.01 billion at the end of the same period.

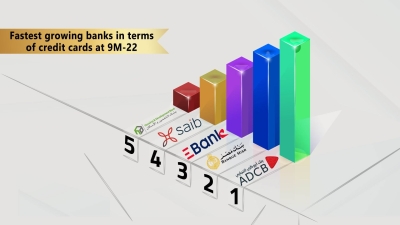

Arab Investment Bank-aiBank was the ninth on the index growing by EGP 9.4 billion during 9 month; thus, its total loans and facilities portfolio increased to EGP 20.7 billion at the end of September 2022, compared to EGP 11.4 billion at the end of December 2021. It was followed by ADCB Egypt which grown by EGP 7.8 billion at the end of the same period.

The figures and values included on the above list are according to the independent financial results announced for each bank by the end of September 2022.

Most performing banks on credit competitiveness at 9M-22

| # | Bank Name | Total loans at 9M-22 | Total loans at 2021-end | Growth Value |

|---|---|---|---|---|

| 1 |

National Bank of Egypt-NBE |

1.46 Trillion pounds | 1.175 Trillion pounds | 285.224 billion pounds |

| 2 |

Banque Misr |

671.818 billion pounds | 606.768 billion pounds | 65.05 billion pounds |

| 3 |

Commercial International Bank-CIB |

197.971 billion pounds | 163.087 billion pounds | 34.884 billion pounds |

| 4 |

Qatar National Bank-QNB  |

215.626 billion pounds | 184.789 billion pounds | 30.873 billion pounds |

| 5 |

arab african international bank |

108.222 billion pounds | 86.11 billion pounds | 22.112 billion pounds |

| 6 |

Banque Du Caire-BDC |

123.835 billion pounds | 106.957 billion pounds | 16.878 billion pounds |

| 7 |

Kuwait Finance House Bank Egypt  |

50.526 billion pounds | 38.748 billion pounds | 11.778 billion pounds |

| 8 |

Abu Dhabi Islamic Bank-ADIB Egypt |

57.435 billion pounds | 47.425 billion pounds | 10.01 billion pounds |

| 9 |

BANK NXT |

20.71 billion pounds | 11.305 billion pounds | 9.405 billion pounds |

| 10 |

Abu Dhabi Commercial Bank Egypt- ADCB |

30.097 billion pounds | 22.29 billion pounds | 7.807 billion pounds |

| 11 |

Export Development Bank of Egypt-EBank |

43.805 billion pounds | 36.35 billion pounds | 7.455 billion pounds |

| 12 |

Housing and Development Bank-HDB |

34.281 billion pounds | 26.936 billion pounds | 7.345 billion pounds |

| 13 |

SAIB BANK |

41.279 billion pounds | 34.102 billion pounds | 7.177 billion pounds |

| 14 |

alBaraka Bank Egypt |

31.227 billion pounds | 24.26 billion pounds | 6.967 billion pounds |

| 15 |

Attijariwafa Bank Egypt |

29.671 billion pounds | 23.959 billion pounds | 5.712 billion pounds |

| 16 |

Al Ahli Bank of Kuwait Egypt -ABK Egypt |

31.676 billion pounds | 26.84 billion pounds | 4.836 billion pounds |

| 17 |

Suez Canal Bank |

30.126 billion pounds | 25.682 billion pounds | 4.444 billion pounds |

| 18 |

Credit Agricole Egypt |

34.794 billion pounds | 30.503 billion pounds | 4.291 billion pounds |

| 19 |

Emirates NBD Egypt |

45.002 billion pounds | 41.557 billion pounds | 3.445 billion pounds |

| 20 |

Bank of Alexandria-Alex Bank |

57.495 billion pounds | 54.2 billion pounds | 3.295 billion pounds |

| 21 |

EGBANK |

27.031 billion pounds | 24.869 billion pounds | 2.162 billion pounds |

| 22 |

Faisal Islamic Bank of Egypt |

14.053 billion pounds | 13.827 billion pounds | 0.226 billion pounds |