Notice of appointment of Barclays Bank PLC as International Sell-Side Advisor alongside Local Financial Advisor CI Capital Investment Banking S.A.E

The Government of Egypt recently announced an ambitious divesture Program, with the objective of increasing the role of the private sector and paving the way for more inclusive and private-sector-led economic growth.

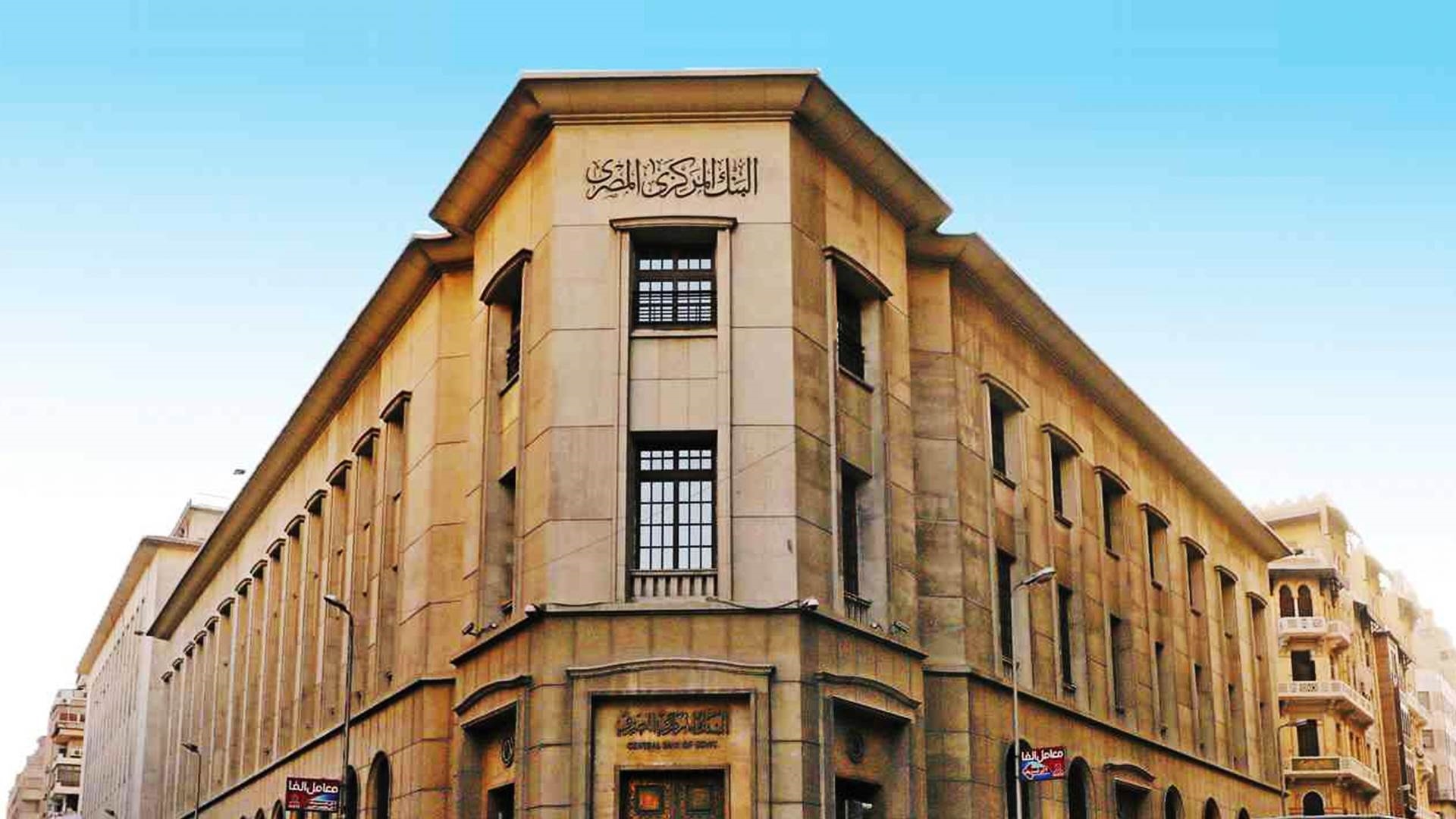

As a part of this Program, the Central Bank of Egypt intends to fully divest its stake in The United Bank. This transaction is considered to be one from a series of divestments by the Egyptian Authorities to be implemented in the upcoming four years.

In order to assist in the execution of the announced divesture Process, The Central Bank of Egypt hereby announce the selection of Barclays Bank PLC, acting through its Investment Bank (“Barclays”), to act as its International Financial Advisor regarding the divesture of The United Bank.

Barclays will execute its mandate alongside CI Capital Investment Banking S.A.E. (“CI Capital”), the appointed Local Financial Advisor.

As part of its reform strategy in Egypt, the Central Bank of Egypt established The United Bank in June 2006 through the merger of three banks: The Egyptian United Bank, The Nile Bank, and Islamic International Bank for Investment and Development.

The United Bank is positioned as one of the leading financial services providers in Egypt, recognizable for its people, strong core values, outstanding performance and sustainable growth.

The United Bank serves its clients through various segments including retail, corporate, small and medium enterprises as well as Islamic Banking services, amongst others.

The United Bank operates through a large network of 68 branches and 211 ATMs and counts 1,730 employees.

As at December 2022, The United Bank had total assets of EGP 60bn, total equity of EGP 10.7bn and strong capitalisation with a 21% Capital Adequacy Ratio.

Barclays is a global universal bank. Barclays supports consumers and small businesses through its retail banking services, and larger businesses and institutions through its corporate and investment banking services.

Barclays Investment Banking provides clients with strategic advice on mergers and acquisitions, corporate finance and financial risk management solutions, as well as equity and debt issuance services.

Barclays Bank PLC is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.