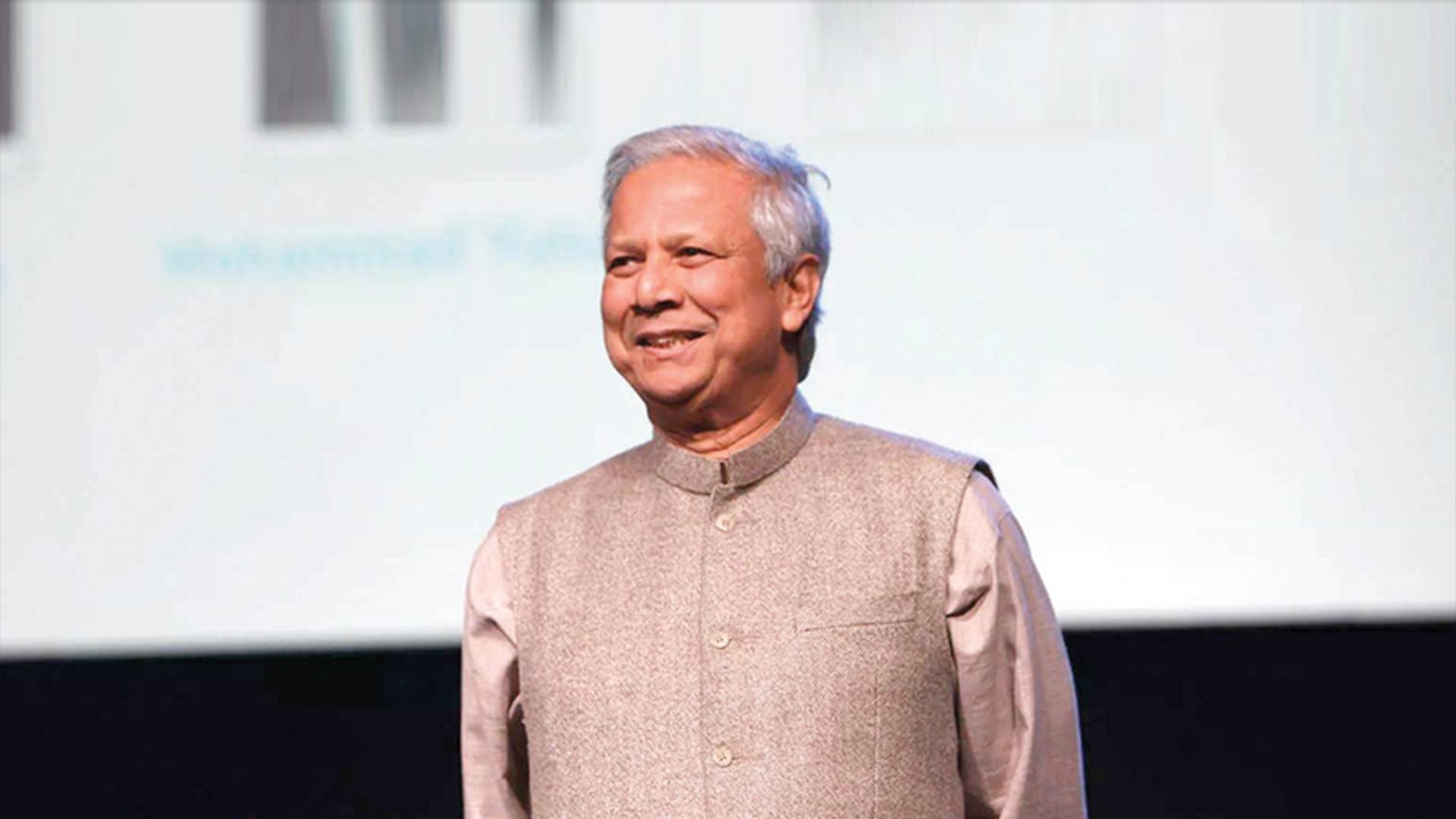

Muhammad Yunus: The Economist Behind the School of Poverty Elimination

Wegdan Mohammed

Poverty is not created by the poor themselves. We are all born entrepreneurs, but some get the opportunity to unleash this potential, while others are not as fortunate or are unaware that they possess this ability in the first place. This is what Professor Muhammad Yunus, the Bangladeshi economist and founder of Grameen Bank, the Nobel Peace Prize laureate in 2006, states.

What is Muhammad Yunus' story with poverty and the poor? What are his achievements that led to him receiving the Nobel Prize? What are his economic ideas and theories? And what has he contributed to his society?

Muhammad Yunus was born in 1940 in the city of Chittagong, a commercial city with a population of about 3 million in the southeastern part of East Bengal, India, which later became part of Pakistan in 1955 and then Bangladesh in 1971.

After graduating from Dhaka University in 1961, Yunus began teaching economics before receiving a Fulbright scholarship to study in the United States in 1965, after Bangladesh achieved its independence in 1971.

Yunus left the United States and returned to his country to assist in its development when he was only 31 years old. Upon his return, he participated in the new government planning committee before resigning due to the ambiguity of his role, and then returned to the economics department at Chittagong University.

From the beginning, Muhammad Yunus took a supportive stance towards his country, Bangladesh, while in exile. He was part of the Bengali student movement that supported independence, which played a significant role in achieving it in the end.

After participating in that movement, he returned to newly independent Bangladesh in 1972 to become the head of the economics department at Chittagong University. The people of Bangladesh were facing difficult living conditions, and in 1974, their suffering worsened due to a famine that resulted in the death of nearly one and a half million people.

Due to the worsening conditions of the poor in his country, Yunus tried to convince the central bank or commercial banks to establish a system for lending to the poor without collateral, which led bank officials to ridicule him and his ideas, claiming that the poor were not eligible for loans.

However, he was determined that the poor were deserving of credit. Afterward, in 1979, he successfully established Grameen Bank in Bangladesh, which provided microcredit loans to the poor, enabling them to engage in small businesses that generate a reasonable income.

When Muhammad Yunus was awarded the Nobel Peace Prize in 2006, jointly with Grameen Bank, which specializes in providing small loans to the poor, as a recognition of his efforts in economic and social development, he announced that he would donate his share of the prize, amounting to $ 1.4 mn, to charitable causes. Yunus' idea achieved tremendous success, as it was replicated in many countries and lifted approximately 100 million people out of poverty.