Reducing interest rates is a probable right decision in the Monetary Policy Committee’s meeting

First Bank

Egypt's inflation rates have seen a record rise over the past two years, and its surge has started since March 2022, with general inflation registering 10.4% and core inflation 10%, and general inflation peaking in September 2023 at 38%, while core inflation reached 41% in June 2023

These increases came as a result of the global crises and wars that have cast a negative shadow over Egypt's economy, from the coronavirus pandemic and supply chains crisis, the Russian-Ukrainian war, to the consequences of Israeli aggression against Gaza, especially the Red Sea unrest, which the International Monetary Fund recently announced deprived Egypt of 75% of its dollar revenues.

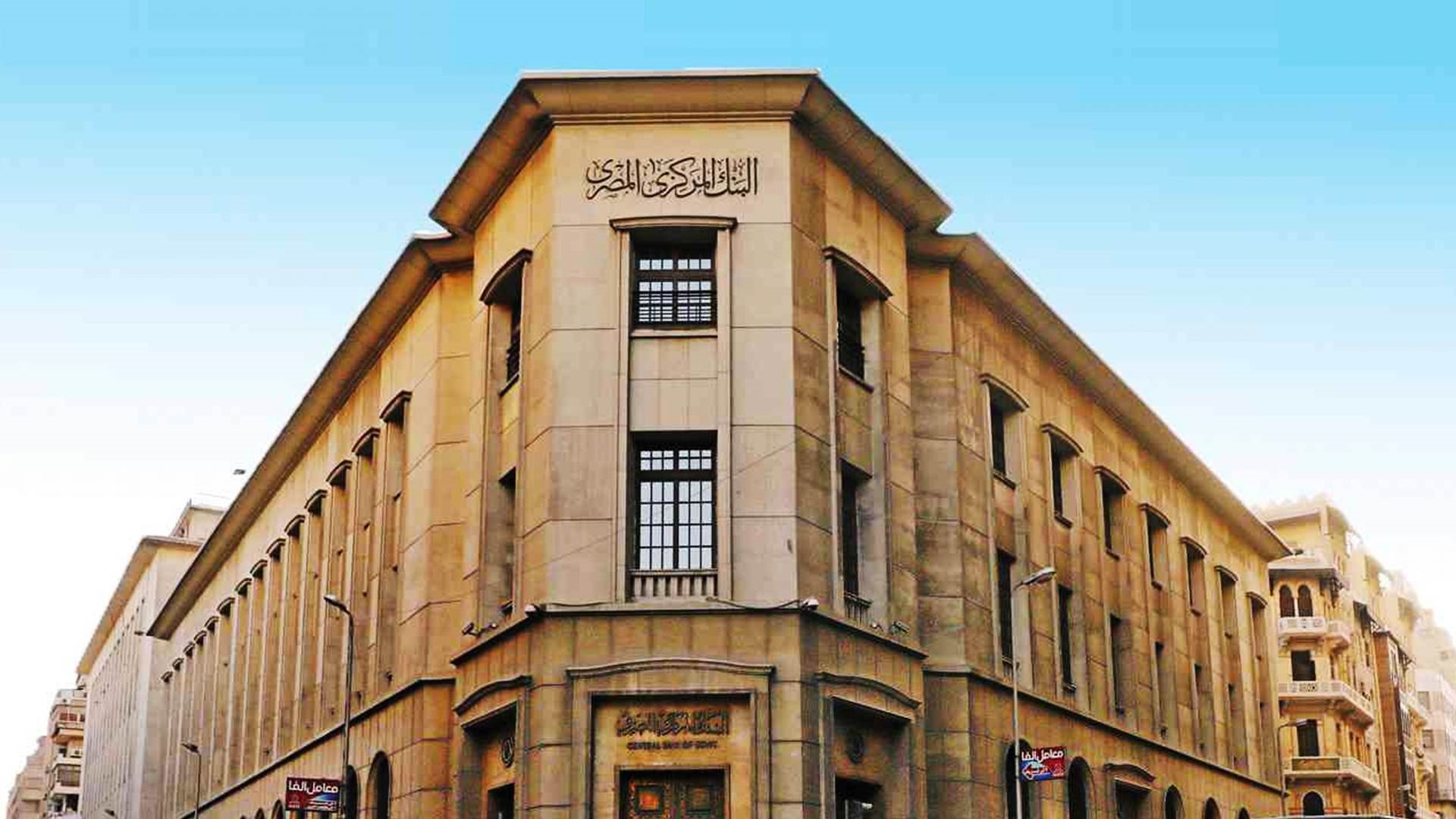

According to Central Bank Law No. 194 of 2020, the Central Bank of Egypt is committed to stabilizing prices in the domestic market as one of its main objectives, within framework of the State's general economic policy, and has resorted to turning its monetary policy framework into a flexible inflation targeting system where inflation expectations act as an intermediary target.

The Central Bank of Egypt has tightened monetary policy to reduce inflation by raising basic interest rates by a total of 19%, equivalent to 1,900 basis points.

The Central Bank has also pursued a number of other tightening policies to restrain inflation, which included increasing the proportion of legal reserve requirements in September 2022 from 14% to 18% to continue the tightening monetary policy. This policy has been strengthened by the cessation of supported lending programmes (Central Bank initiatives) and increasing the volume of liquidity absorption.

As the meeting of the Central Bank's Monetary Policy Committee will be held shortly to discuss interest rates, scheduled for Thursday, July 18, what is the best solution in the current situation?

In fact, the high interest rates is not a good solution at the moment, as it has become a significant burden for the State and employers especially as it reaches record levels, which may affect negatively the country's GDP growth rates. Accordingly, in the light of current economic variables, CBE should take into account the decision of reducing interest rates at the Committee's next meeting, in the light of several considerations, the most important of which are:

The notable improvement in some economic indicators, especially inflation, as the core annual inflation rate fell to 27.1% in May, compared to 34.2% in December 2023, the overall inflation rate fell to 27.4% by the end of May 2024, compared to 35.2% by the end of last year.

The slowing growth in the money supply over the past months, which has been somewhat effective in controlling inflation, according to CBE data; The volume of the money supply rose to EGP 2.570 tn by the end of May 2023, compared to EGP 2.370 tn by the end of 2023, and cash trading outside the banking system recorded EGP 1.197 tn by the end of May 2024, compared to EGP 1.068 tn by the end of 2023.

The Central Bank of Egypt managed to control the foreign exchange market and eliminate the phenomenon of the black market, where one of the goals of the recent interest move of about 600 basis points was to encourage individuals to waive the dollar and convert it into high-return domestic deposits.

Reduction of the State's financial burden on domestic debt in order to fill the budget deficit

Encourage investment relatively in financing decisions to implement its investment expansion, some of which have been stopped as a result of high interest rates and dependency on the cost of financing.

The Central Bank still has other effective tools that can be used to control the levels of the money supply and by dependence to control inflation such as open market operations and the legal reserve of banks that can help fight inflation without burdening investors and the country with additional financial burdens.