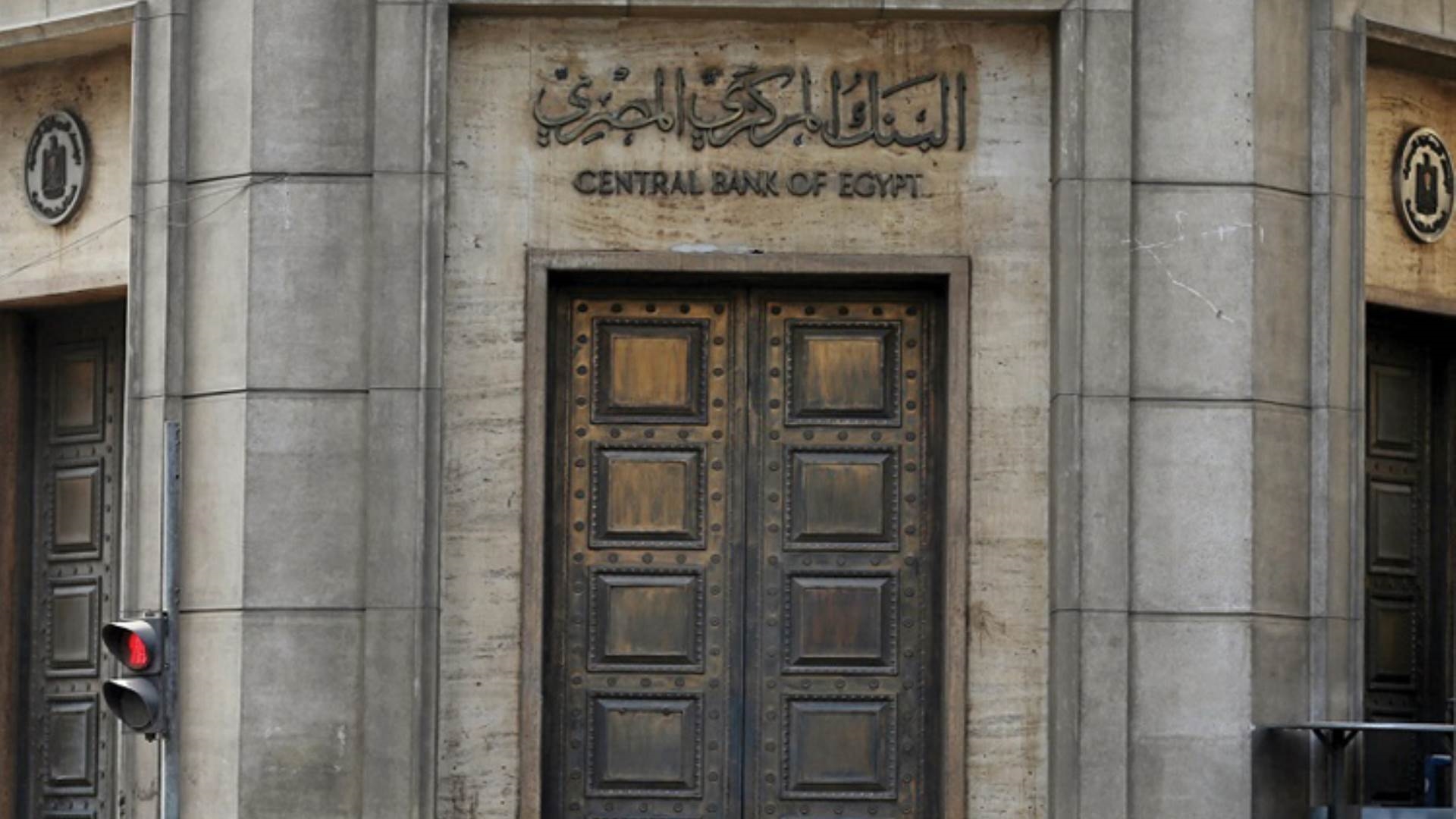

CBE hands off responsibility for managing subsidized initiatives to Ministry of Finance

The Central Bank of Egypt is going to stop launching and providing funding for subsidized loans and pass the responsibility to the housing, finance and tourism ministries, under a decree issued by Prime Minister Moustafa Madbouly in the Official Gazette

For the past couple of years, the CBE has run initiatives designed to improve access to finance for key areas of the economy. Tourism companies, low- and middle-income homebuyers, farmers wanting to invest in water-efficient irrigation systems, and people applying for the government’s dual-fuel vehicle swap scheme have all been able to take out loans from commercial banks at preferential interest rates subsidized by the central bank.

The housing, finance and tourism ministries will now be responsible for funding the subsidized rates.

All entities, including the CBE itself, will be banned from financing new initiatives or amending existing ones that would increase burdens on public finances without cabinet approval.

The Finance Ministry has been tasked with running an audit on the initiatives and making a decision on how (or whether) to continue providing them without CBE

As of 19 November, the Ministry of Finance took over responsibility for establishing the rules for each initiative, setting the maturity for each, assigning the entity that will manage each initiative and assigning the body that will finance each initiative.

The action aims to benefit the public budget using the yields of these initiatives, according to the CBE.

Accordingly, the Ministry of Housing and Urban Development will be responsible for the real-estate financing initiative with decreasing-eight-percent interest rates that benefit the middle-income class, as well as the three-percent decreasing interest rate initiative dedicated to the low and middle-income classes.

Meanwhile, either the Ministry of Tourism and Antiquities or the Tourism Support Fund will be in charge of the tourism sector support initiative, with decreasing 11 percent interest rate.

The Ministry of Finance will also manage the initiatives converting petrol-operated vehicles to dual-fuel and supporting modern irrigation systems.