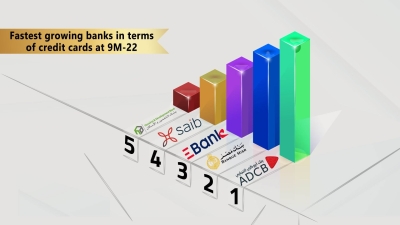

ADIB Egypt, E Bank, Credit Agricole fastest growing banks in mortgage loans at 9M-22.

First Bank conducted a list of the fastest growing banks in terms mortgage loans during the first 9 months of the year; ADIB Egypt topped the list, as its portfolio jumped 334.67%, to record 159.3 million pounds by the end of September 2022, compared to 36.7 million by the end of December 2021.

The list monitored mortgage loans portfolios in 17 banks operating in the Egyptian banking sector. It revealed that 14 banks achieved positive growth rates in their mortgage loan portfolios, while 3 banks recorded a decline in their mortgage loan portfolios during the first 9 months from 2022.

Returning to the list, the Export Development Bank of Egypt-E Bank ranked second place with a growth rate of 117.7%. Its mortgage loan portfolio increased to 357.3 million pounds at the end of September 2022, compared to 164.1 million pounds at the end of December 2021. It was followed by Credit Agricole Egypt at a rate of 66.25% during the first 9 months of last year.

saib Bank came in fourth place, with a growth rate of 53.73% during the first 9 months of 2022, its mortgage loan portfolio recorded 1.454 billion pounds at the end of last September, compared to 945.6 million at the end of December 2021.

QNB Al Ahli ranked fifth, with a growth rate of 52.19% during the first 9 months of the past year. Its mortgage loan portfolio recorded 4.332 billion pounds at the end of September 2022, compared to 2.846 billion at the end of December 2021. It was followed by the Arab African International Bank at a rate of 44.40% during the same period.

The National Bank of Egypt was ranked seventh with a growth rate of 30.31%, recording EGP 15.696 billion at the end of September 2022 compared to EGP 12.045 billion at the end of December 2021. It was followed by Banque Misr at a rate of 29.34% during the first 9 months of last year. .

The Arab Investment Bank came in ninth place at a rate of 25.49% during the first 9 months of 2022, after its mortgage loan portfolio recorded EGP 545.8 million at the end of September 2022 compared to EGP 435 million at the end of December 2021. It was followed by the Commercial International Bank at a rate of 25.03% during the same period.

It should be noted that all values and growth rates mentioned in the above analysis are according to the separated financial statements announced for each bank at the end of September 2022.

Mortgage loans portfolio growth in Banks during 9M

| # | Bank Name | Value at Sep.2022-end | Value at Dec.2021-end | growth rate |

|---|---|---|---|---|

| 1 |

Abu Dhabi Islamic Bank-ADIB Egypt |

159.3 million pounds | 36.7 million pounds | 334.67 % |

| 2 |

Export Development Bank of Egypt-EBank |

357.3 million pounds | 164.1 million pounds | 117.7 % |

| 3 |

Credit Agricole Egypt |

388.3 million pounds | 233.7 million pounds | 66.25 % |

| 4 |

SAIB BANK |

1.454 billion pounds | 945.6 million pounds | 53.73 % |

| 5 |

Qatar National Bank-QNB  |

4.332 billion pounds | 2.846 billion pounds | 52.19 % |

| 6 |

arab african international bank |

1.51 billion pounds | 1.046 billion pounds | 44.4 % |

| 7 |

National Bank of Egypt-NBE |

15.696 billion pounds | 12.045 billion pounds | 30.31 % |

| 8 |

Banque Misr |

12.2 billion pounds | 9.432 billion pounds | 29.34 % |

| 9 |

BANK NXT |

545.8 million pounds | 435 million pounds | 25.49 % |

| 10 |

Commercial International Bank-CIB |

3.094 billion pounds | 2.474 billion pounds | 25.03 % |

| 11 |

Faisal Islamic Bank of Egypt |

1.064 million pounds | 871.5 million pounds | 22.03 % |

| 12 |

Housing and Development Bank-HDB |

10.322 billion pounds | 8.533 billion pounds | 20.96 % |

| 13 |

alBaraka Bank Egypt |

650.3 million pounds | 565.04 million pounds | 15.09 % |

| 14 |

Banque Du Caire-BDC |

3.078 billion pounds | 2.693 billion pounds | 14.32 % |

| 15 |

EGBANK |

318.5 million pounds | 320.6 million pounds | -0.65 % |

| 16 |

Abu Dhabi Commercial Bank Egypt- ADCB |

189.2 million pounds | 196.3 million pounds | -3.61 % |

| 17 |

Bank of Alexandria-Alex Bank |

3.889 million pounds | 8.923 million pounds | -56.42 % |