CIB's Loan Portfolio Grows 255.7% Over 5 Years

The Commercial International Bank – Egypt (CIB) has demonstrated outstanding performance in the lending sector over the past five years, driven by well-structured financial policies that accelerated credit expansion, resulting in unprecedented growth rates.

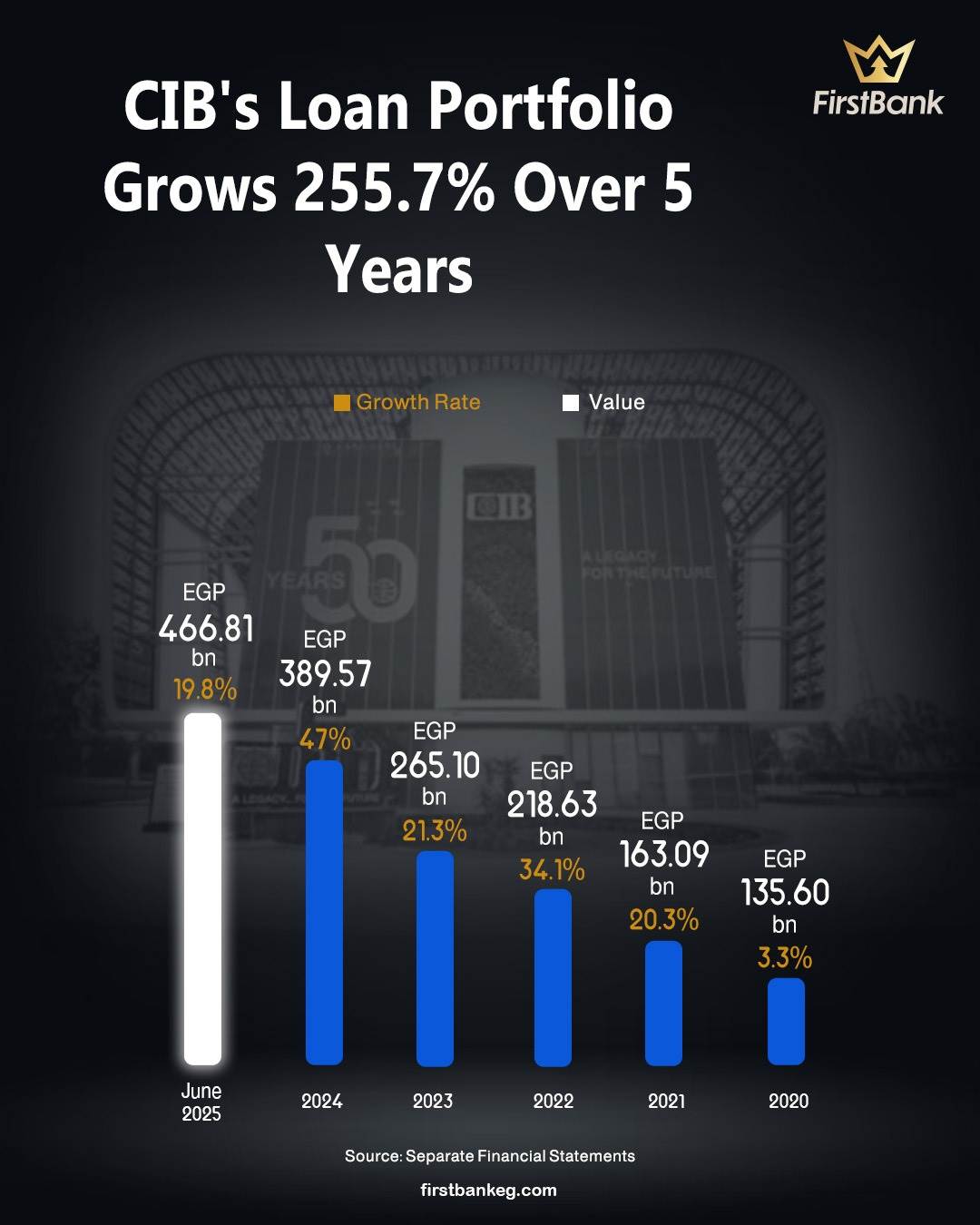

A recent analysis conducted by First Bank revealed that the Commercial International Bank – Egypt (CIB)’s total loans to customers rose to EGP 466.81 bn by the end of June 2025, compared to EGP 131.24 bn at the end of 2019, marking a growth rate of 255.7% and an increase of EGP 335.57 bn.

This remarkable achievement reflects a sustained journey of growth and excellence in providing financing to both individuals and corporations, as evidenced by the rise of its corporate loan portfolio to EGP 381.90 bn by the end of June 2025, up from EGP 103.97 bn at the end of 2019, marking a growth rate of 267.3%

Retail banking also played a pivotal role, with individual loans rising by approximately 211.3% during the analysis period, reaching EGP 84.92 bn by mid-2025, compared to EGP 27.28 bn at the end of 2019.

On the broader financial performance front, CIB continued to post strong results across key indicators.

Net profit rose to EGP 33.41 bn in the first half of 2025, up from EGP 27.68 bn during the same period in 2024, reflecting a 20.7% increase of EGP 5.73 bn.

Profit before income tax reached EGP 46.40 bn in the first six months of 2025, up from EGP 38.56 bn in H1 2024, marking a 20.3% growth.

Net interest income surged by 23.4%, totaling EGP 51.15 bn, compared to EGP 41.44 bn in the same period last year, an increase of EGP 9.71 bn.

Net fees and commissions income climbed to EGP 4.12 bn in H1 2025, up from EGP 3.40 bn during the same period in 2024, recording a 21.3% rise.

Regarding the Financial Position, total assets increased by 8.7% in the first half of 2025, reaching EGP 1.31 tn by June, up from EGP 1.21 tn at the end of 2024.

Customer deposits also grew to EGP 1.04 tn by mid-2025, compared to EGP 967.90 bn at the end of 2024, marking a 7.5% increase of EGP 72.34 bn.