Emirates NBD Egypt’s Retail Deposits Skyrocket 256.7% in 5 years to reach EGP 62.97 bn

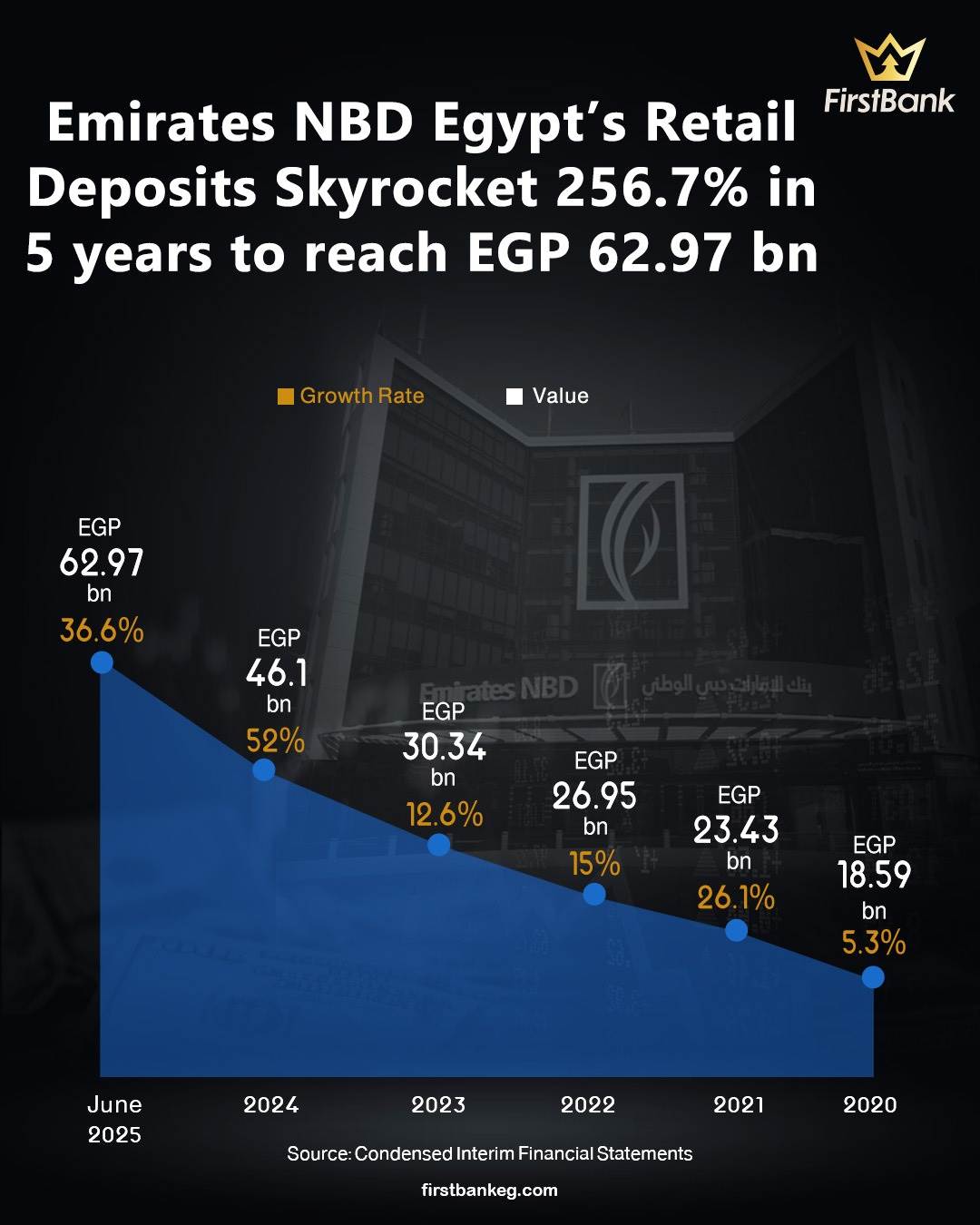

Emirates NBD – Egypt’s retail deposit portfolio has witnessed remarkable growth over the past five years, surging to EGP 62.97 bn by the end of June 2025, up from EGP 17.65 bn at the close of 2019 – a jump of 256.7% or an additional EGP 45.32 bn.

Tracking the portfolio’s performance over the period reveals that the bank recorded its fastest annual growth last year, with retail deposits climbing 52% to reach EGP 46.1 bn by the end of 2024, compared to EGP 30.34 bn in 2023 — an increase of roughly EGP 15.76 bn.

The second-strongest annual growth came in 2021, when the portfolio rose 26.1% to EGP 23.43 bn by year-end, up from EGP 18.59 bn at the end of 2020.

In the first half of 2025, retail deposits jumped again, rising 36.6% year-to-date to EGP 62.97 bn by June, compared to EGP 46.1 bn at the end of 2024.

Overall, Emirates NBD – Egypt delivered robust results in 2025. Net profit surpassed EGP 3 bn, up 20% from EGP 2.5 bn in the same period of 2024.

Pre-tax profit increased 16% year-on-year to EGP 4.39 bn for H1 2025, compared to EGP 3.77 bn in H1 2024.

Net interest income climbed 17% to reach EGP 6 bn in H1 2025 versus EGP 5 bn in the same period last year.

Fee and commission income also grew, rising 14% to EGP 918 mn in H1 2025, compared to EGP 809 mn in H1 2024.

Shareholders’ equity advanced 15% to EGP 20 bn as of June 2025, up from EGP 17 bn at the end of 2024.

On the lending side, total loans grew 15% to EGP 97 bn by mid-2025, versus EGP 84 bn at the end of 2024, including EGP 76 bn in corporate loans and EGP 21 bn in retail loans.

Total customer deposits rose 15% in H1 2025 to EGP 148 bn, compared with EGP 128 bn at the end of 2024.