NBE's Growing Interest In Financing Corporates And Direct Loans

The National Bank of Egypt is the largest lender to corporates, as a natural result of its growing interest in supporting and financing the corporate sector and major projects, in addition to its focus on supporting small and medium enterprises.

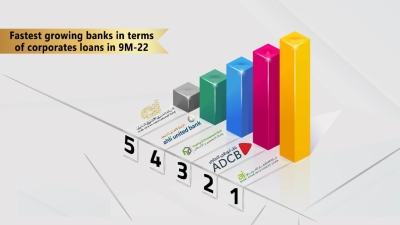

The bank was able to increase its financing to corporates during the first 9 months of 2022 by 237.74 billion pounds, corporates loans portfolio jumped to 1.25 trillion pounds at the end of last September, compared to 1.02 EGP 1 trillion by the end of 2021, achieving a growth rate of 23.41%.

This comes as a result of an increase in the current debit accounts with the bank by 51.71%, to record 487.46 billion pounds at the end of the third quarter of 2022, compared to 321.31 billion pounds at the end of 2021, an increase of 166.15 billion pounds.

Debit current accounts acquired 38.89% of the bank's total financing for corporates at the end of last September, compared to 31.64% at the end of 2021.

While the syndicated loan portfolio jumped to 238.38 billion pounds at the end of the third quarter of 2022, compared to 212.98 billion pounds at the end of 2021, achieving 11.93%, and an increase of 25.41 billion pounds, recorded 19.02% of total corporates loans at the end of last September.

Due to the NBE's great care to syndicated loan deals , based on the strong and growing of relationships that link the bank with local banks and regional and international financing corporates.

This contributes positively to supporting the country's economic development, localizing the industry, reducing imports and increasing export rates, thus providing more job opportunities for young people and increasing economic growth rates.

The direct loan portfolio grew by 7.79%, to record 525.56 billion pounds at the end of September 2022, compared to 487.601 billion pounds at the end of 2021, an increase of 37.96 billion pounds.

Direct loans account for the largest share of corporates loans, recorded 41.93% by the end of the third quarter of 2022.

Corporates financing share reached 85.84% of the bank’s total financing, EGP 1.46 trillion, by the end of September 2022.