CIB adds EGP 124.02 bn to its deposit portfolio during 2022

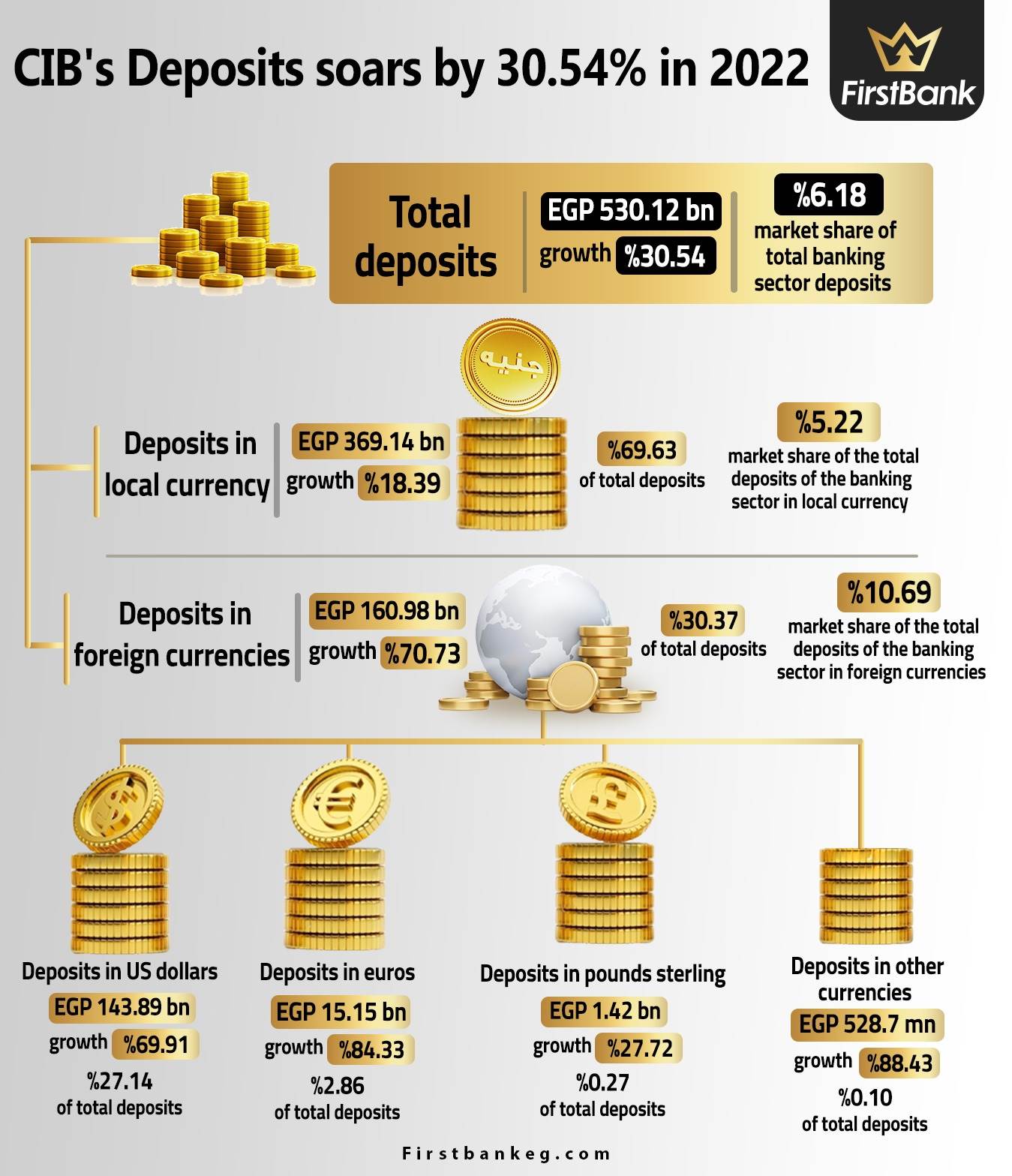

CIB’s deposit portfolio witnessed a remarkable growth over the past year, as it jumped by 30.54%, to reach EGP530.12 bn by the end of 2022, compared to EGP406.10 bn by the end of 2021, occupying the third place on First Bank list of the fastest growing listed banks in total deposit portfolios.

Although CIB succeeded in increasing its deposit portfolio by EGP 124.02 bn, this was not enough to support its market share or even ensure that it would not decline.

During the past year, the bank lost 0.12% of its market share, as its share in the deposit market declined to 6.18% of the total banking sector deposits by the end of 2022, compared to 6.30% by the end of 2021.

Deposit portfolio in local currency increased from EGP311.81 bn at the end of 2021 to EGP 369.14 bn at the end of 2022, with a growth rate of 18.39%, and an increase of EGP 57.33 bn.

Egyptian pound acquired the largest share of the bank’s deposits, as its share reached 69.63% by the end of 2022.

Despite the bank’s success in making significant increases in its EGP portfolio, it was not sufficient to increase its market share, as it declined to 5.22% of total banking sector deposits in local currency by the end of 2022, compared to 5.52% by the end of 2021.

CIB’s deposit portfolio in foreign currencies jumped by 70.73% over the past year, to reach EGP 160.98 bn by the end of 2022, compared to EGP94.29 bn by the end of 2021.

CIB’s deposits in foreign currencies acquired 30.37% of the bank’s total deposits by the end of 2022.

It is worth noting that despite the bank’s success in adding EGP 66.69 bn to it over the past year, this was not sufficient to increase its share in this market, as its market share declined to 10.69% of total deposits of the banking sector in foreign currencies by the end of 2022, compared to 11.69% by the end of 2021.

Deposits in Euros were the fastest growing during 2022, as they jumped 84.33%, to record EGP15.15 bn at the end of last year, compared to EGP 8.22 bn at the end of 2021, an increase of EGP6.93 bn, constituting 2.86% of the bank’s total deposits.

US dollar constitutes 27.14% of the bank's total deposits, The bank’s deposit portfolio in US dollars jumped to EGP 143.89 bn at the end of 2022, compared to EGP84.68 bn at the end of 2021, with a growth rate of 69.91%, and an increase of EGP59.20 bn.

The bank’s deposit portfolio in pound sterling rose by 27.72%, to reach EGP1.42 bn at the end of 2022, compared to EGP1.11 bn at the end of 2021, an increase of EGP307.42 mn, constituting 0.27% of the bank’s total deposits.

While bank deposits in other currencies increased by 88.43%, to reach EGP 528.7 mn by the end of 2022, compared to EGP280.6 mn by the end of 2021, an increase of EGP 248.12 mn.

Deposits in other foreign currencies acquired a very small share of the total bank deposits, reaching 0.10% by the end of 2022.

It is worth noting that corporate deposits with CIB witnessed a significant growth over the past year, as it jumped by 45.79%, to record EGP262.22 bn by the end of 2022, compared to EGP179.86 bn by the end of 2021, an increase of EGP82.36 bn.

The bank’s individual deposits portfolio increased from EGP 226.24 bn at the end of 2021 to EGP 267.90 bn at the end of 2022, with a growth rate of 18.41%, and an increase of EGP 41.66 bn.