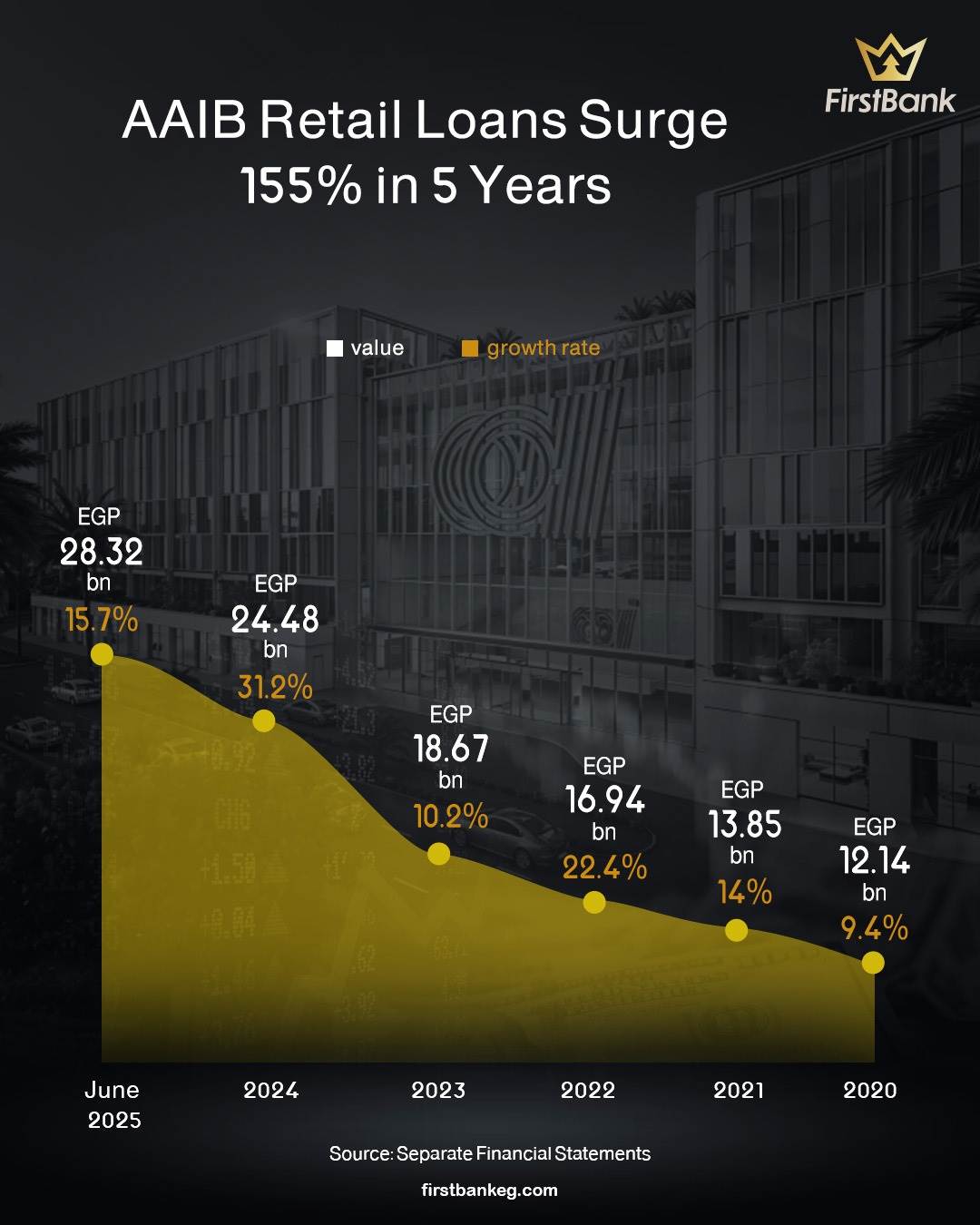

AAIB Retail Loans Surge 155% in 5 Years

Arab African International Bank (AAIB) has significantly expanded its retail lending portfolio over the past five years, with individual loans rising to EGP 28.32 bn by the end of June 2025, up from EGP 11.10 bn at the close of 2019. This reflects a remarkable growth rate of 155.2% and an overall increase of EGP 17.22 bn.

This robust performance in the retail loan portfolio underscores AAIB’s strategic focus on strengthening its role in retail banking, aiming to meet the diverse needs of its customers.

The growth also highlights customers’ increasing trust in the bank’s services and its ability to deliver innovative, flexible financing solutions that help individuals achieve their financial goals.

A closer look at the growth trajectory shows that 2024 was the standout year, with the portfolio recording the fastest annual expansion and the largest absolute increase. Retail loans climbed by 31.2% year-on-year to reach EGP 24.48 bn at the end of 2024, compared with EGP 18.67 bn at the end of 2023—an increase of EGP 5.82 bn.

In the current year, the momentum continued as the portfolio rose to EGP 28.32 bn by the end of June 2025, up from EGP 24.48 bn at the close of 2024, reflecting a growth rate of 15.7% and an increase of EGP 3.84 bn.

Beyond retail lending, AAIB maintained solid financial performance across its key indicators. Net profit reached EGP 8.1 bn in the first half of 2025, up 25% compared to the same period in 2024.

Net interest income came in at EGP 14.8 bn for the first six months of 2025, underscoring the strength of the bank’s business model and its balanced strategy for delivering sustainable returns.

The bank’s total financial investments stood at EGP 340.5 bn by the end of June 2025, while customer deposits climbed to EGP 665 bn over the same period.

AAIB’s total assets grew to EGP 926.6 bn by June 2025, compared with EGP 923.6 bn at the end of 2024, reflecting a half-year growth rate of 0.3%.

Customer loans also posted strong growth, rising to EGP 222.54 bn by June 2025 from EGP 202.09 bn at the close of 2024—a 10.1% increase, equivalent to EGP 20.45 bn.