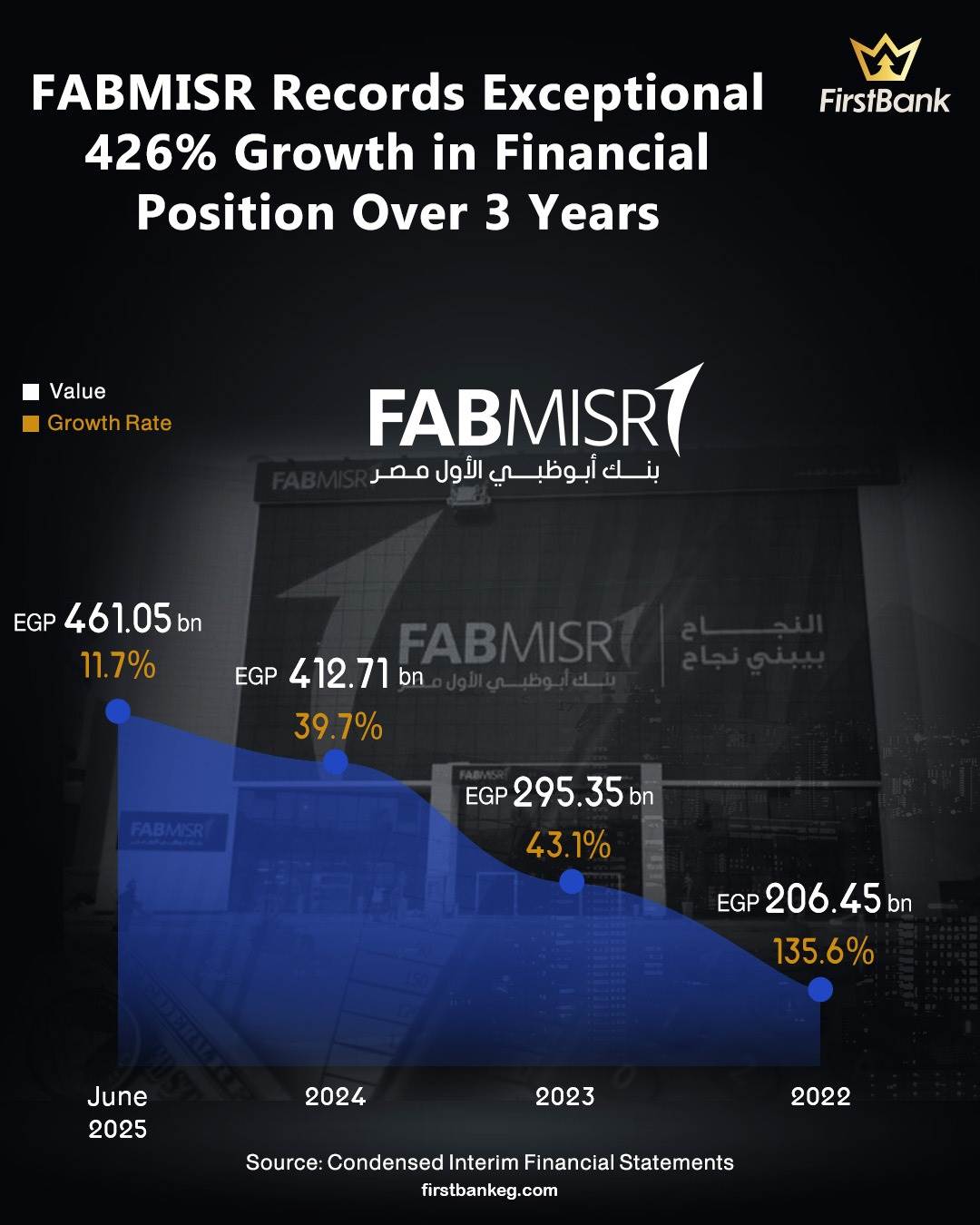

FABMISR Records Exceptional 426% Growth in Financial Position Over 3 Years

FABMISR has witnessed remarkable asset growth since acquiring Bank Audi – Egypt in 2022, with total assets surging from EGP 87.64 bn at the end of 2021 to EGP 461.05 bn by June 2025—an impressive 426% increase.

This extraordinary expansion underscores the bank’s successful execution of its merger and acquisition strategies and its ability to fully leverage Bank Audi’s assets within its operational framework, strengthening its presence in an increasingly competitive market.

The bank’s robust performance has also boosted its market share, which jumped to 1.92% of total banking sector assets in Egypt by June 2025, up from 1.02% at the end of 2021, positioning FABMISR as the seventh-largest bank in the market by asset size.

On the financial performance front, FABMISR continued to deliver strong results in 2025, reporting a net profit of EGP 8.6 bn for the first half of the year.

Shareholders’ equity rose 10% in the first six months of 2025, reaching EGP 66.6 bn by the end of June, reinforcing a solid capital base to support future growth initiatives.

In parallel, the bank maintained solid operational efficiency, with net interest income reaching EGP 14.6 bn and net fee and commission income increasing 7% to EGP 1.4 bn in H1 2025, reflecting a well-balanced strategy to diversify revenue streams.

Customer deposits grew by 11% in the first six months of the year, climbing to EGP 288.5 bn by June 2025, underscoring sustained customer confidence in the bank’s ability to attract and retain deposits in a highly competitive banking landscape.

Total customer loans rose to EGP 166.61 bn by June 2025, up from EGP 148.90 bn at the end of 2024, marking an 11.9% growth rate and an increase of EGP 17.71 bn.