How CBE' governor solved the year's crisis

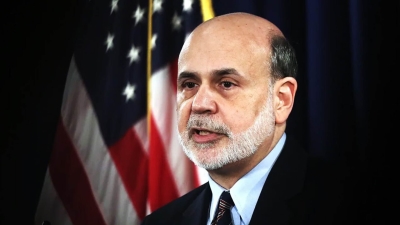

Hassan Abdullah, Governor of the Central Bank of Egypt, proved his ingenuity in Less than a year, under extremely difficult global conditions; the Russian-Ukrainian war and the inflation crisis in the local market through, in addition to the noticeable decline in Egypt's reserves of foreign exchange, and the spread of the black market for foreign exchange trading.

So How did Abdullah faced all these crises?

Since his assumption on August 18, Hassan Abdullah has been determined to study the economic situation in Egypt, inflation rates, the foreign exchange market, and the appropriate time to deal with the exchange rate and interest rates. Within this framework, he held meetings to discuss the situation and study what is most appropriate for the economy.

His first decision was to facilitate corporates' work procedures, as he canceled the deposit limits for individuals and corporates on August 25, 2022, and raised the maximum withdrawal limit, by increasing the maximum limit for cash withdrawals for individuals and corporates from EGP50 to 150 thousand , while maintaining the maximum withdrawal limit ofEGP 20,000 per day from ATMs.

Hassan Abdullah’s wise decisions continued, to decide in the September 22, 2022 meeting, to fix interest rates, like raising the mandatory cash reserve ratio from bank deposits to 18% instead of 14%.

Abdullah continued his bold steps to reform the economy and monetary policy, so he moved the exchange rate without explicitly announcing that, and about 22 days before he moved it, to give the local currency greater flexibility, he informed the banks on October 5, 2022, that he would allow them to start trading non-exchange futures contracts for local currency transactions.

This is within the framework of a new mechanism under review by banks for foreign exchange, to deal with the price of EGP against the dollar.

And with the continued escalation of inflation, he raised the interest rate by 2% in an extraordinary meeting on October 27, 2022, and moved the price of EGP against US dollar, in order to adopt a flexible exchange rate for the local currency, and work to rebuild international reserves.

Hassan Abdullah re-supported foreign exchange reserves, and his efforts in this file resulted in an increase in Egypt's foreign reserves for six months in a row, to reach $34.352 bn last February, compared to $33.143 bn at the end of July 2022, that is, before he took over.

He also succeeded in reaching a final agreement with IMF, so that the Fund announced last December that it would grant Egypt $3 bn directly, $1 bn from another fund affiliated with it, and stimulate investments and financing worth approximately $14 bn from Egypt's international and regional partners.

The International Fund was impressed by the strong reforms that changed Egypt's monetary policy, which he expressed in his report announcing that Egypt had obtained the loan.

The International Fund praised the movement of the exchange rate and its flexibility in Egypt, noting that the intense guidance of the exchange rate - by fixing EGP against US dollar since Corona pandemic in 2020 until the beginning of 2022 - is no longer beneficial to Egypt.

This led to a decline in foreign exchange assets at CBE and commercial banks, rationing of foreign exchange, and CBE suddenly devalue the Egyptian pound against other currencies.

However, Hassan Abdullah's reforms did not succeed in limiting the rising inflation, due to global reasons, which forced him, in the last meetings of the Monetary Policy Committee during 2022, to raise interest rates, as the rates for the one-night deposit and lending return, and the transaction price were raised. The main rates of the central bank increased by 300 bp, to reach 16.25%, 17.25%, and 16.75%, respectively, and the credit and discount rates were raised by 300 bp, to reach 16.75%.

Abdullah worked to change the obligatory work with the system of collection documents, in imports, to announce, on December 29, the return to documentary credits, to receive this step with great acceptance by the business community, investors, and importers, as it will contribute to the entry of goods and imported goods from abroad, especially the production requirements that you need. Industrial projects.

With the beginning of the new year, Hassan Abdullah sought to move the exchange rate again, to address the large gap that still exists between the official rates and the black market, in an effort to eliminate it, which pushed the price of the dollar to reach the level of 32 pounds before it began to decline to a level below 31 pounds.

This decision greatly affected the foreign currency market, as it greatly reduced the pressure on dollar demand in Egypt, and prompted the interbank market to achieve very high levels of transactions compared to previous periods, which enhanced the dollar supply in the market and relieved pressure on it.

In the first of the Monetary Policy Committee of CBE in 2023, they announced fixing interest rates on deposits and lending in last February’s meeting, but with the increase in inflationary pressures, the committee raised them by 2%, last week.

He also worked to greatly support industry, encourage productive sectors and enhance local production, as with the Prime Minister launching a new initiative to support the productive sectors (industry and agriculture), CBE informed local banks of new financing initiative issued by Ministry of Finance, in favor of private sector companies operating in industrial and agricultural activities at a return rate of 11%.

CBE stated that the total value of the initiative reached EGP 150 bn, of which EGP 140 bn is for financing working capital operations, and EGP 10 bn is for financing equipment.

Hassan Abdullah's efforts resulted in achieving a net profit for the first time in five years, reaching EGP1.058 bn during December 2022.

Asset portfolio rose to EGP3.574 tn by the end of 2022, compared to EGP3.108 tn at the end of last year, achieving a growth rate of 14.99%, and an increase of EGP465.99 bn.

Gold assets rose by 35.63%, to reach EGP180.964 bn by the end of 2022, compared to EGP133.427 bn at the end of July of the same year, an increase of EGP 47.537 bn.