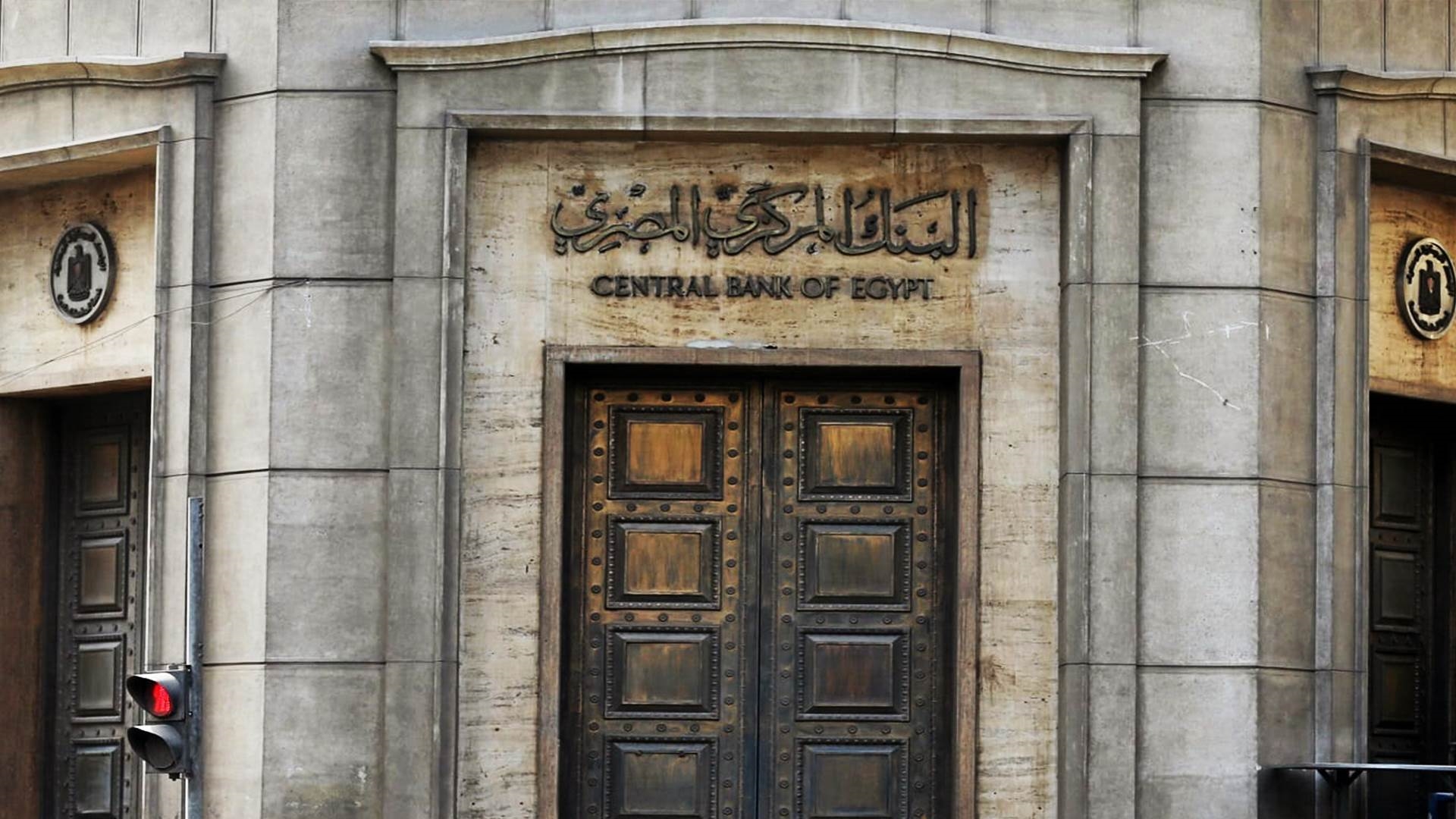

CBE Requested Unconditional Guarantee from Foreign Banks for Digital Branch Deposits Coverage

First Bank

The Central Bank of Egypt has requested an unconditional guarantee from the head offices of foreign banks to cover all deposits in their digital foreign bank branches in Egypt, including the rights of creditors and all other obligations.

This comes alongside the commitment of the main center to compensate for any financial losses that may result in the digital foreign bank branch's failure to comply with the minimum regulatory requirements, especially those related to the capital adequacy standard, within 1 month from the date of approval of the auditors' accounts for the digital foreign bank branch.

CBE has also required foreign digital bank branches seeking a license to submit documents, including a statement from the foreign bank's head office, outlining the services it provides on behalf of the digital branch in Egypt, if any, as well as the applications and systems related to screening negative lists, combating money laundering, and combating domestic and international terrorism financing (such as remittances applications, Know Your Customer, and high-risk customer transaction monitoring).

Moreover, CBE has issued licensing, registration, supervision, and control regulations for digital banks, representing an important step in keeping pace with global developments in the financial technology industry and meeting the needs of customers in the Egyptian market, as part of the state's efforts to support innovation and transition to the digital economy.

CBE emphasized the necessity for the foreign bank's head office to commit to Egyptian laws, regulations, valid decisions, and instructions issued by CBE.

Also added that the applicant must have one of the legal forms of an Egyptian joint-stock company, with all its shares nominal, and its issued and fully paid-up capital not less than EGP2 bn or the equivalent in freely convertible currencies.

A foreign bank branch can obtain a license if its head office has a specific nationality and is subject to the supervision of a regulatory authority in the country where its head office is located, and its capital allocated for the activity of the foreign digital bank branch in Egypt is not less than $60 mn or the equivalent in freely convertible currencies.

The conditions included that a financial corporate should be among the shareholders, representing the largest proportion of ownership among the shareholders and their related parties, and that this proportion should not be less than 30% of the capital. The referred financial corporate should also have a track record in similar activities, and an exception to this condition may be granted after obtaining the approval of the Central Bank's board of directors.

The conditions also included clarity of ownership structure, including related parties, to ensure identification of the ultimate beneficiaries and verification of the legitimacy of the source of funds.

Furthermore, the license should not contradict the public economic interest of the state, lead to a disruption of competition rules, or prevent monopolistic practices. The trade name adopted by the digital bank should not be similar or identical in a way that creates confusion with another bank's name or another entity.

CBE emphasized the necessity of integrity, good reputation, and financial solvency for the concerned parties (such as founders, ultimate beneficiaries, members of the board of directors, and responsible executives).

In addition to the aforementioned, the following are required for the foreign digital bank branch or the Egyptian joint-stock company affiliated with a foreign bank or a foreign financial institution:

-The head office should have a specific nationality.

-The head office should be subject to the supervision of the corresponding regulatory authority in the country where it is located and obtain that authority's approval to operate in Egypt.

-The corresponding regulatory authority should apply the principle of consolidated supervision and express no objection to the application of the principle of joint supervision with CBE.

-The foreign bank's head office should have policies to combat corruption, bribery, fraud, money laundering, and terrorism financing.

If the foreign bank or foreign financial corporate obtains a credit rating from one of the global credit rating agencies (S&P, Fitch Ratings, Moody's), evidence of that should be provided.